Blue Bulletin

Majors Industries

September 2025

Natural Gas

Market Conditions

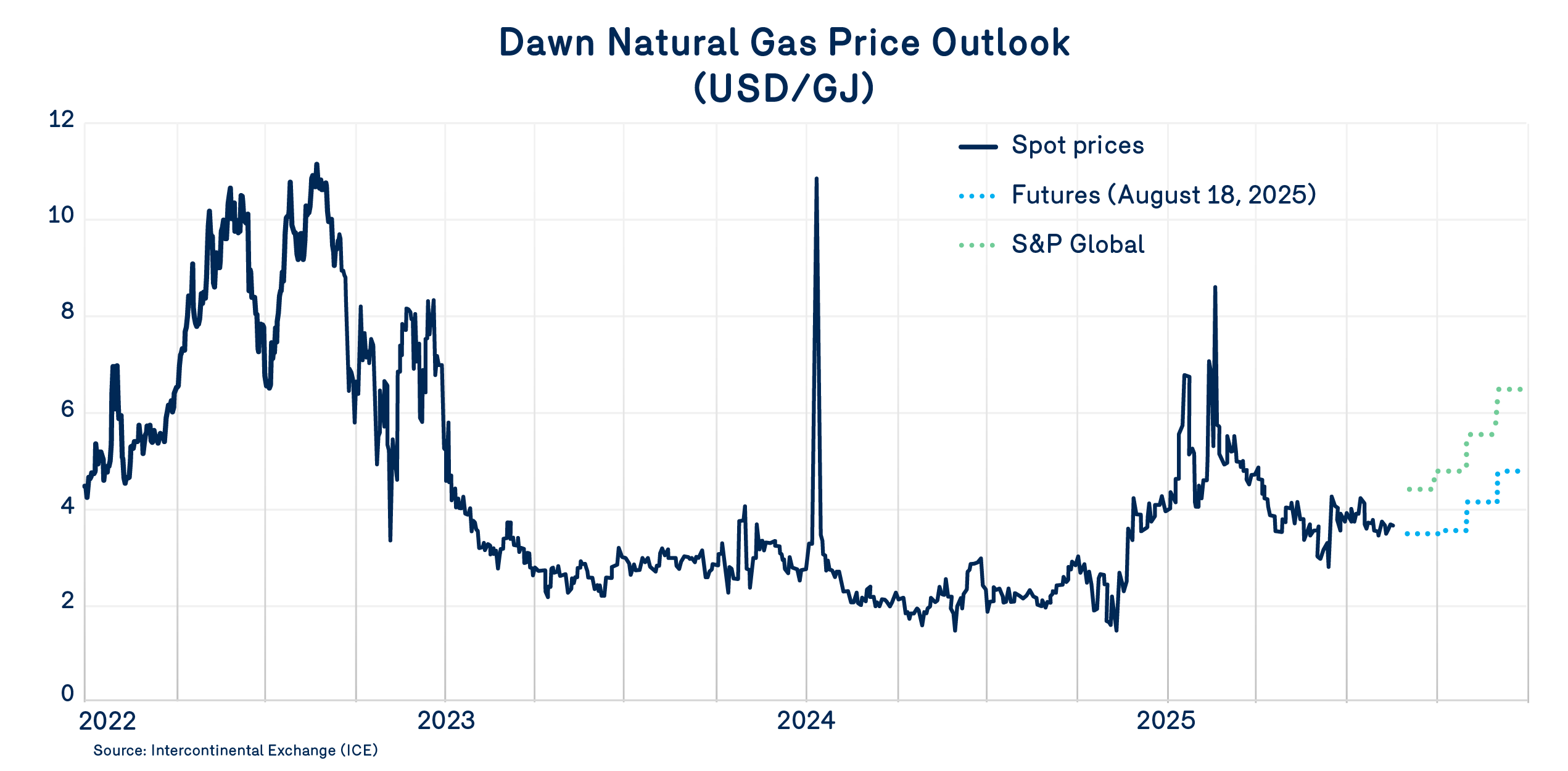

As the summer season draws to a close, the North American natural gas market continues to show unexpected strength, offering a more optimistic price outlook compared to late winter 2024–2025.

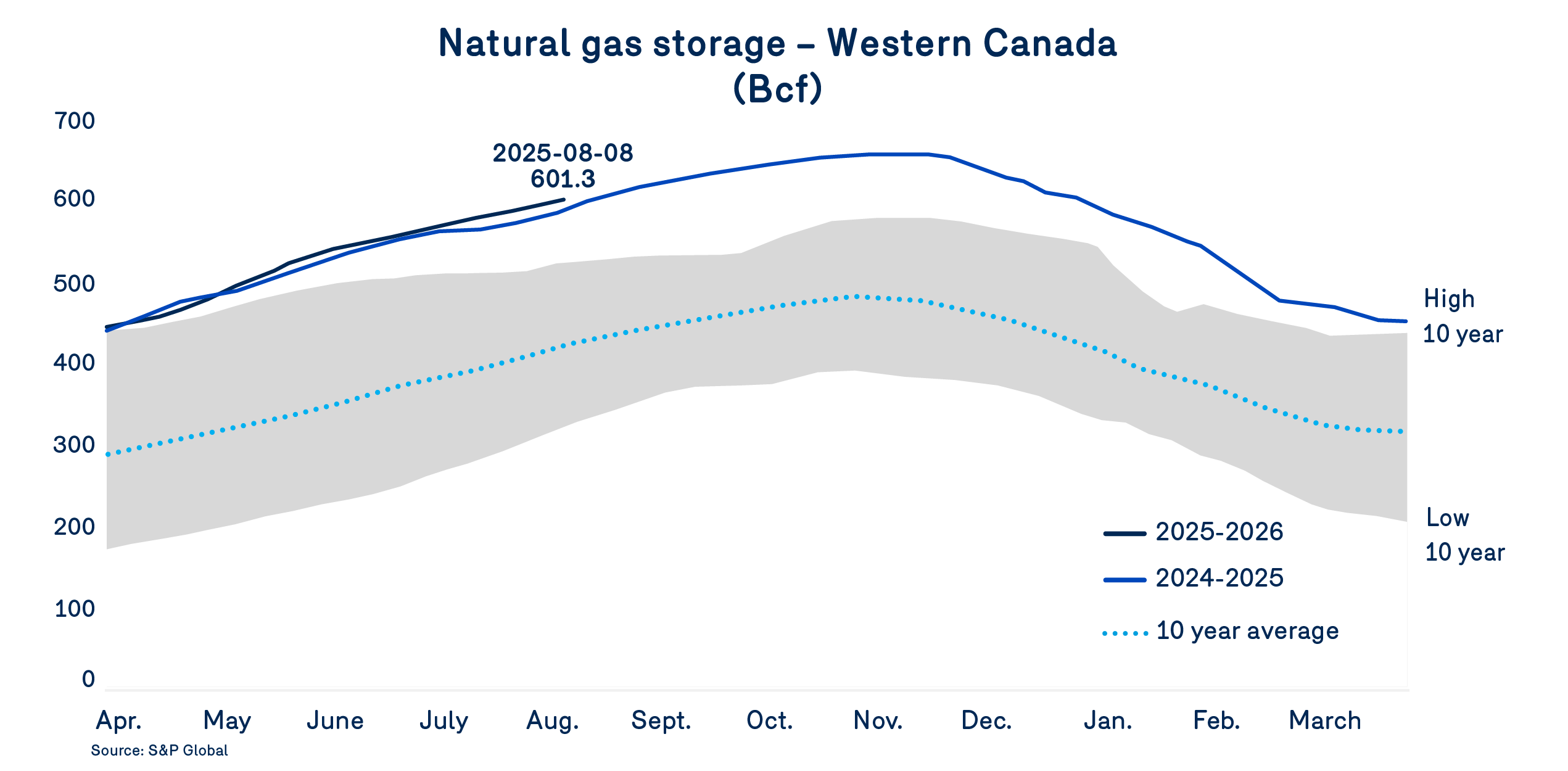

In Canada, natural gas production increased year-over-year in anticipation of higher U.S. domestic consumption. However, this demand failed to materialize due to milder-than-expected temperatures. As a result, surplus production has significantly contributed to record-high storage levels in Western Canada for a second consecutive year.

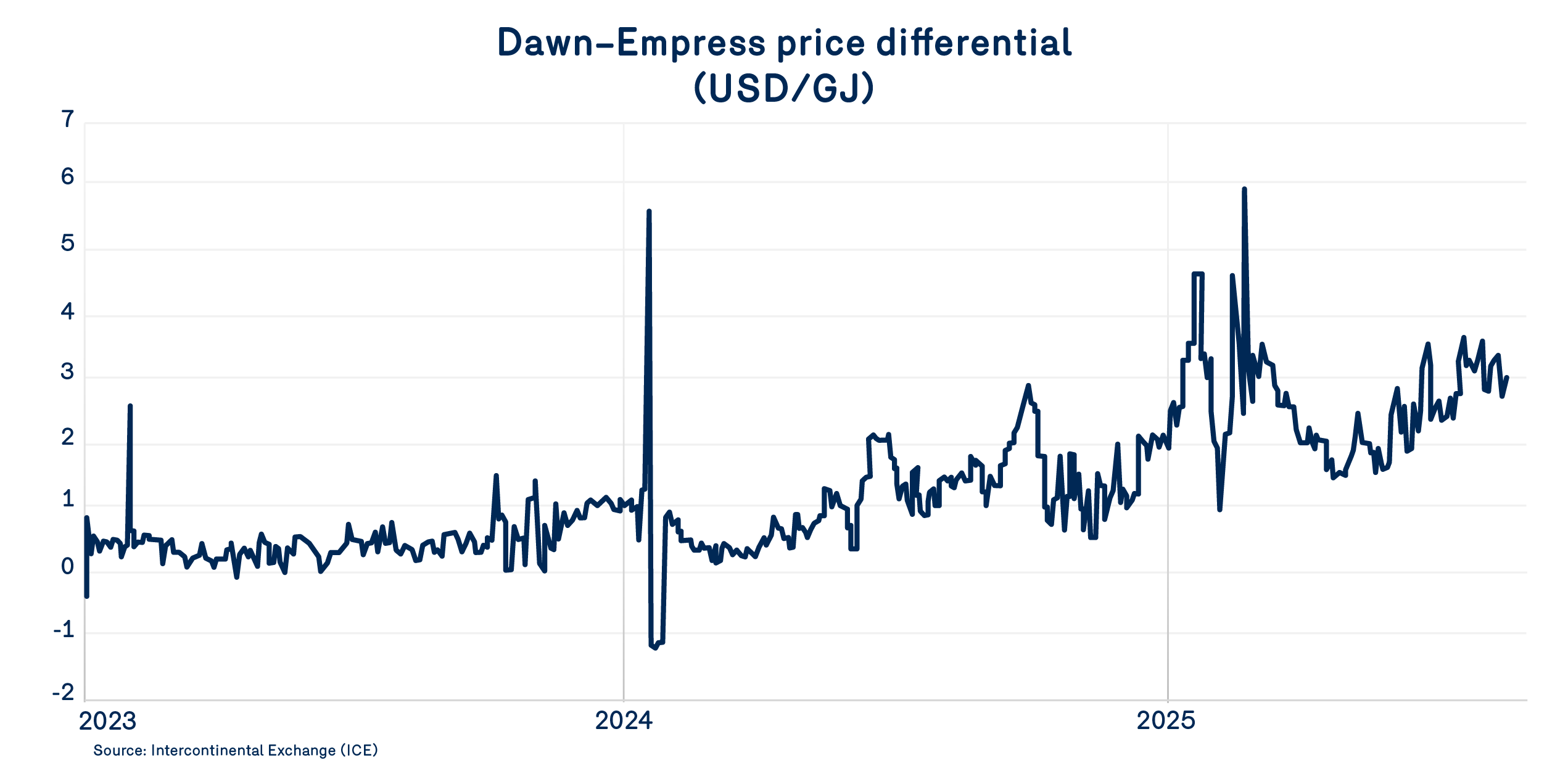

As has been the case for over a year, storage levels have driven down Western Canadian prices compared to other continental benchmarks. Since June 2024, prices at the AB-NIT and Empress hubs have consistently traded at a discount of more than $1/GJ compared to Dawn, with recent weeks seeing spreads widen to as much as $3/GJ.

Given the current storage situation in Western Canada, there is little reason to expect these price differentials to narrow in the short or even medium term. Only a surge in winter demand would be likely to draw down inventories enough to reduce their downward pressure on Western Canadian prices. Without such demand, prices at Western Canadian hubs are expected to remain significantly lower than those at other continental points.

In the United States, the gas market balance has stabilized since late last winter, dampening the previously anticipated upward pressure on prices.

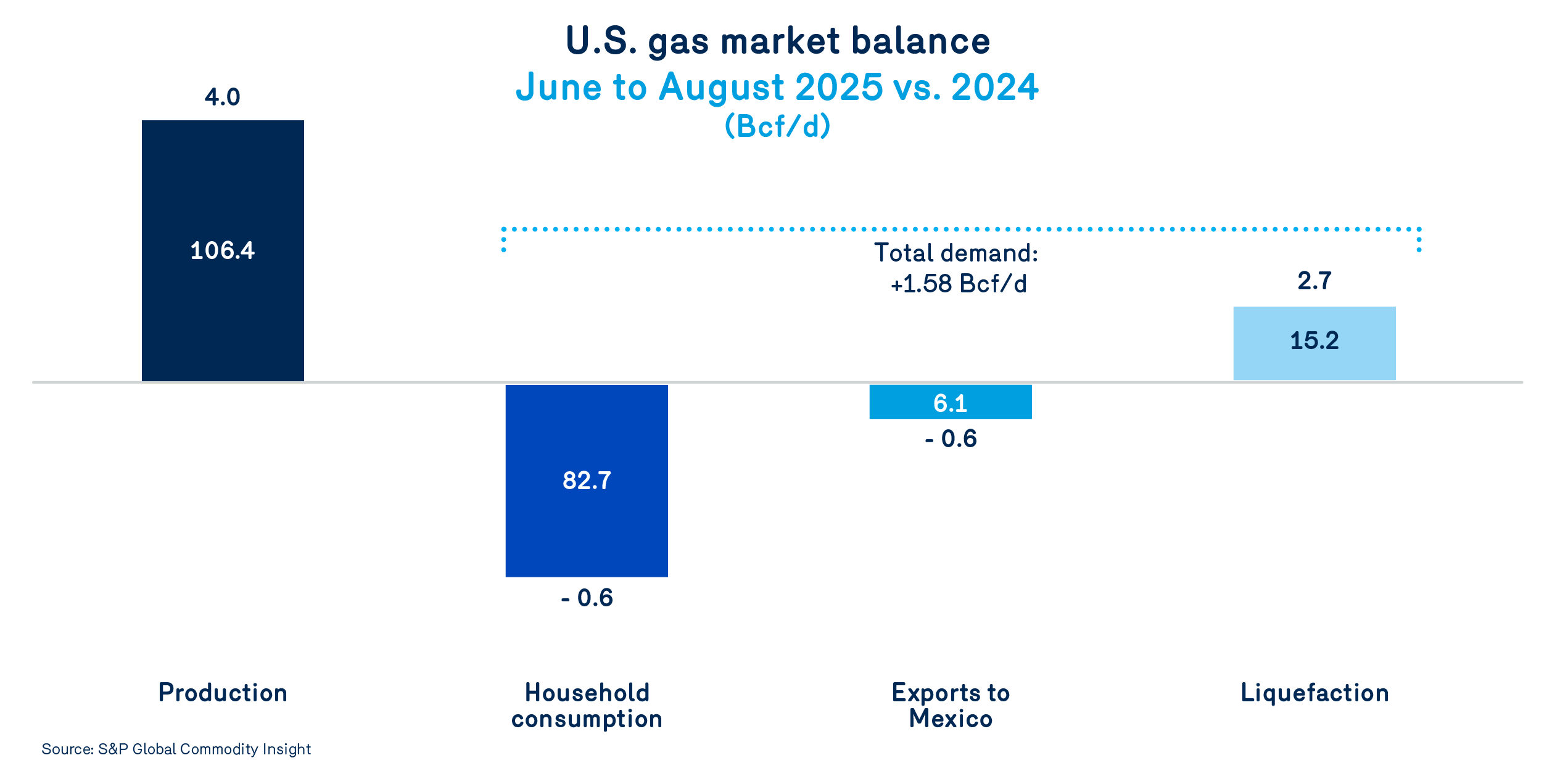

Natural gas production saw a solid increase of 4.0 Bcf/day (+3.9%) between June and August 2025 compared to the same period in 2024. This was driven by growing demand for LNG exports and supported by relatively strong market prices, although partially offset by falling oil prices, which have reduced associated gas output—particularly in oil basins located farther from liquefaction facilities.

On the demand side, signals have been mixed. While high summer temperatures pushed electricity generation to record levels, this increase was fuelled primarily by renewables (+15.2%) and coal (+7.2%), not natural gas, which saw a 4.4% decline. Including consumption in the residential, commercial and industrial sectors, overall U.S. domestic demand during summer 2025 was lower than in 2024.

However, LNG demand remains a bright spot. Recent capacity additions allowed LNG-related gas demand to average 15.2 Bcf/day over the past three months—up by 2.7 Bcf/day compared to summer 2024.

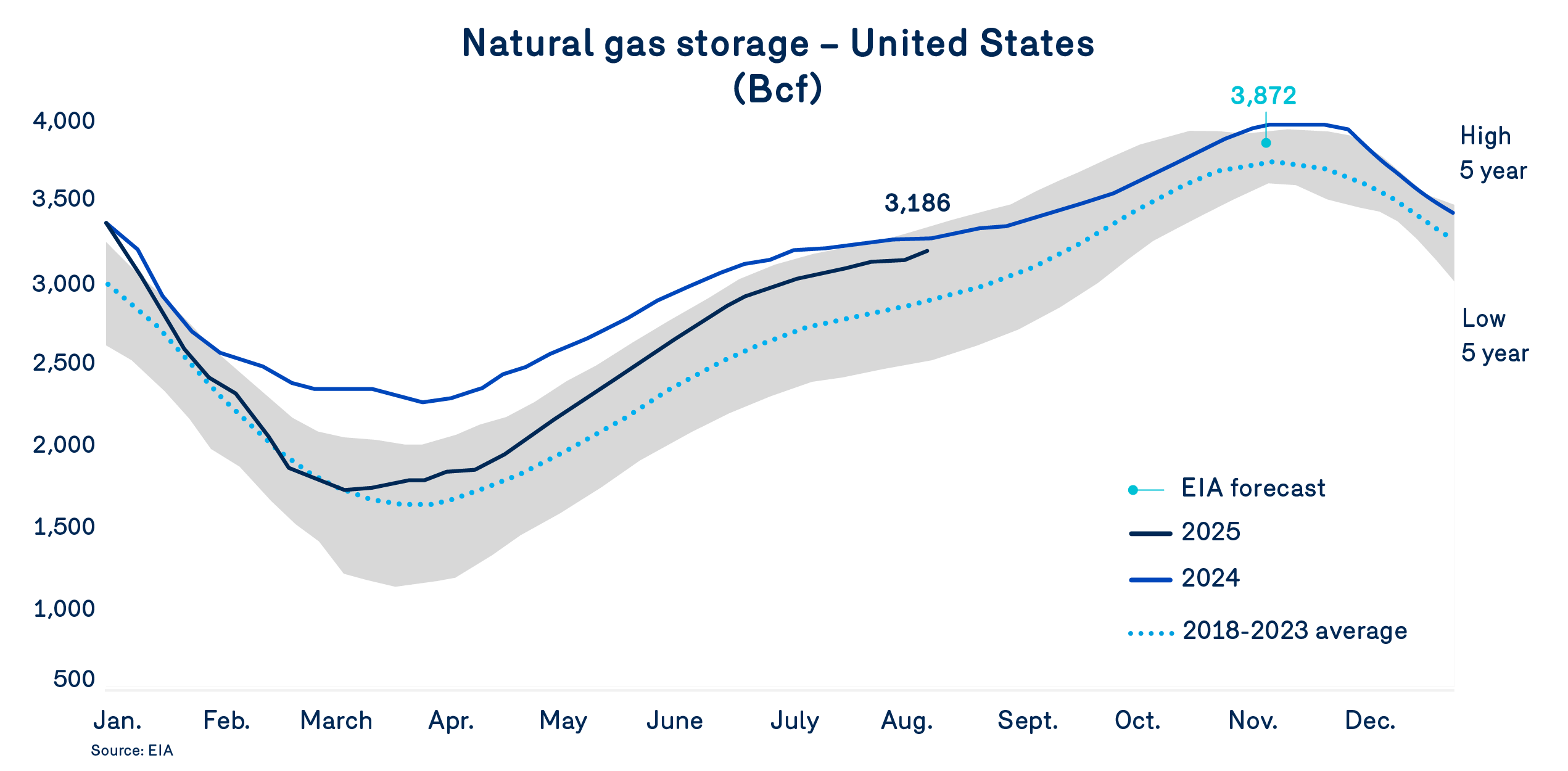

All told, production growth (+4 Bcf/day) has significantly outpaced total demand growth (+1.5 Bcf/day), resulting in strong injections into storage. At the start of the injection season in late March 2025, U.S. gas storage levels were at about 80% of where they stood in 2024. They have since climbed to 3,186 Bcf, nearly 98% of last year’s level. This well-supplied position is exerting downward pressure on spot prices and prompting many experts to revise their winter forecasts lower.

It is still too early to accurately predict natural gas prices for the coming winter. Current forecasts are based on expectations of normal or near-normal temperatures. However, as winter approaches, the likelihood of a significant price spike appears to be fading, in favour of a more moderate price environment. For example, price forecasts for September 2025 are down by 12% to 14% compared to those issued in April—a pattern that could repeat in the coming months, particularly for January and February 2026.

While many factors could still influence natural gas prices this winter, current projections remain higher than last year. The most recent market data shows an average winter price of $4.70/GJ at the Dawn hub—a 5.7% increase over the average for the 2024–2025 winter season.

In the background, the U.S. Energy Information Administration (EIA) is forecasting a 1.2% increase in natural gas production, a 2.4% decline in domestic consumption and an 18.8% increase in LNG export demand. Overall, these projections suggest that storage withdrawals this winter will be lower than last year, with total storage levels by late March 2026 expected to match those of March 2025—a scenario that is not currently raising concerns in the market.