Major Industries Bulletin — March 2024

Natural Gas Market Conditions

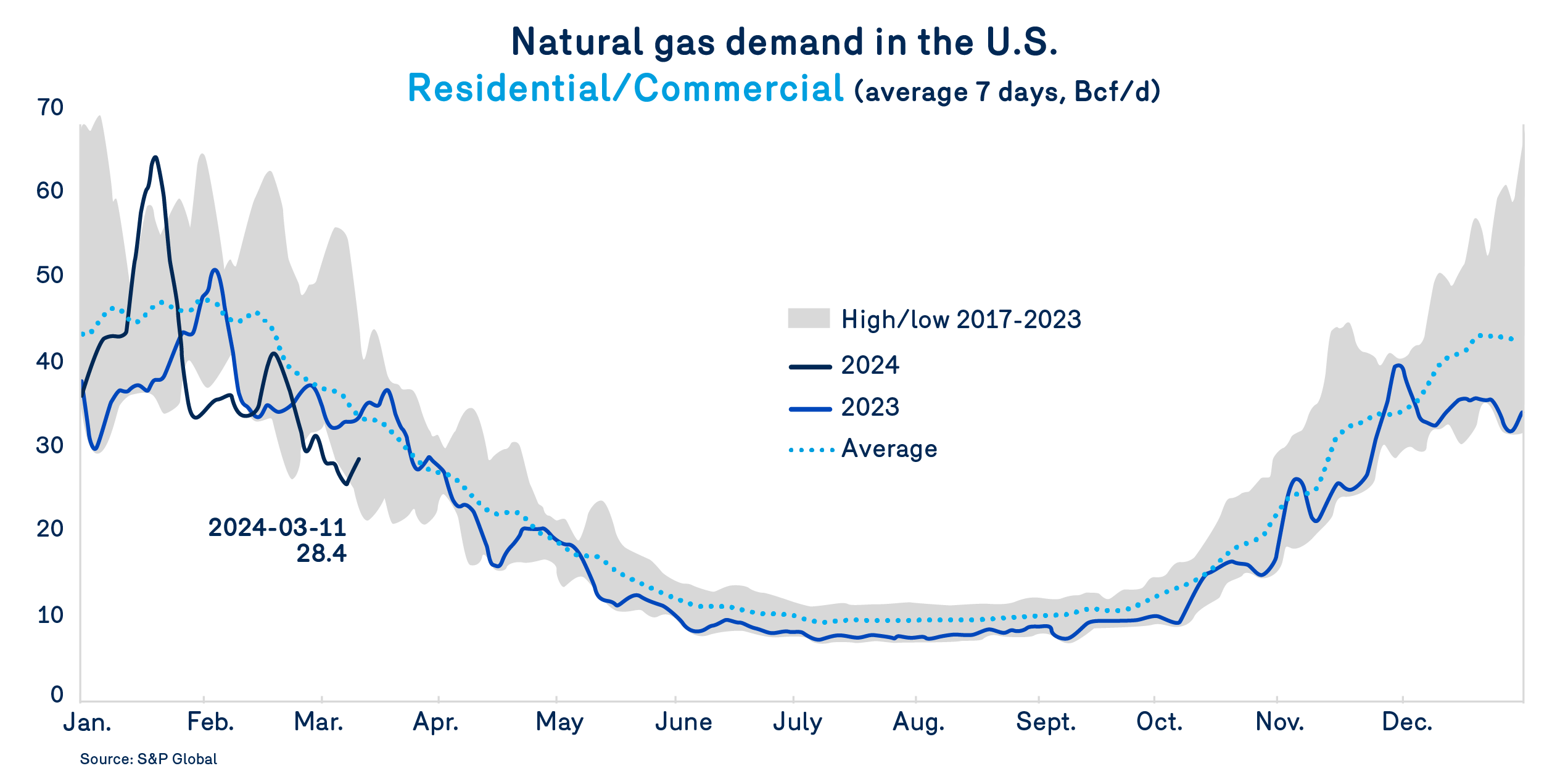

Unusually high temperatures in recent months, particularly in February, have had a definite impact on natural gas demand in North America and around the world. In the United States, warmer-than-average winter temperatures have triggered a sharp decline in heating requirements and, in turn, reductions in demand for natural gas from the residential and commercial sectors.

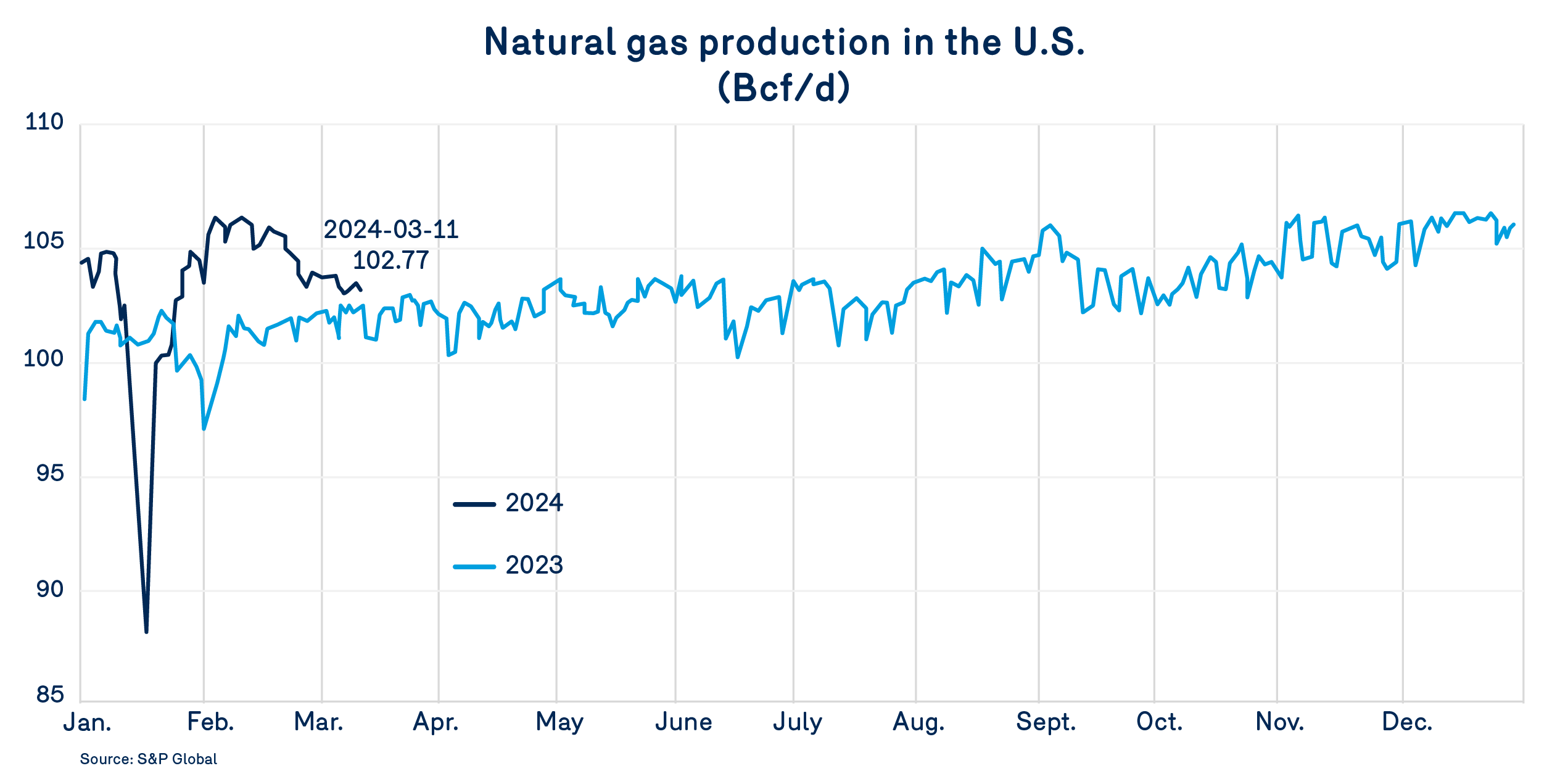

Demand has not only been below average over the past few months, it has sunk to its lowest level of the past seven years. Meanwhile, natural gas production exceeded that of 2023 at this time of year. This has resulted in a supply/demand situation that depresses natural gas prices. These record low prices benefit consumers but undermine producers’ profitability, despite the productivity gains they’ve made in recent years.

Several producers have already announced lowered production targets. Drilling activity shows a slight decline and the number of wells in reserve (drilled-but-uncompleted wells, or DUCs) are at historically low levels. However, no real downward trend has appeared yet. New liquefaction capacity is expected to boost natural gas production, particularly in the oil and gas basins in the south-central United States.

So despite occasional headwinds, most gas market forecasts predict a momentary correction in the pace of production followed by a slight upturn by the end of 2024. According to the latest U.S. Energy Information Administration (EIA) forecasts, U.S. natural gas production is expected to increase next winter (2024-25) by +0.7 Bcf/d to an average of 105.2 Bcf/d. None of these forecasts point to a sharp rebound in natural gas prices.

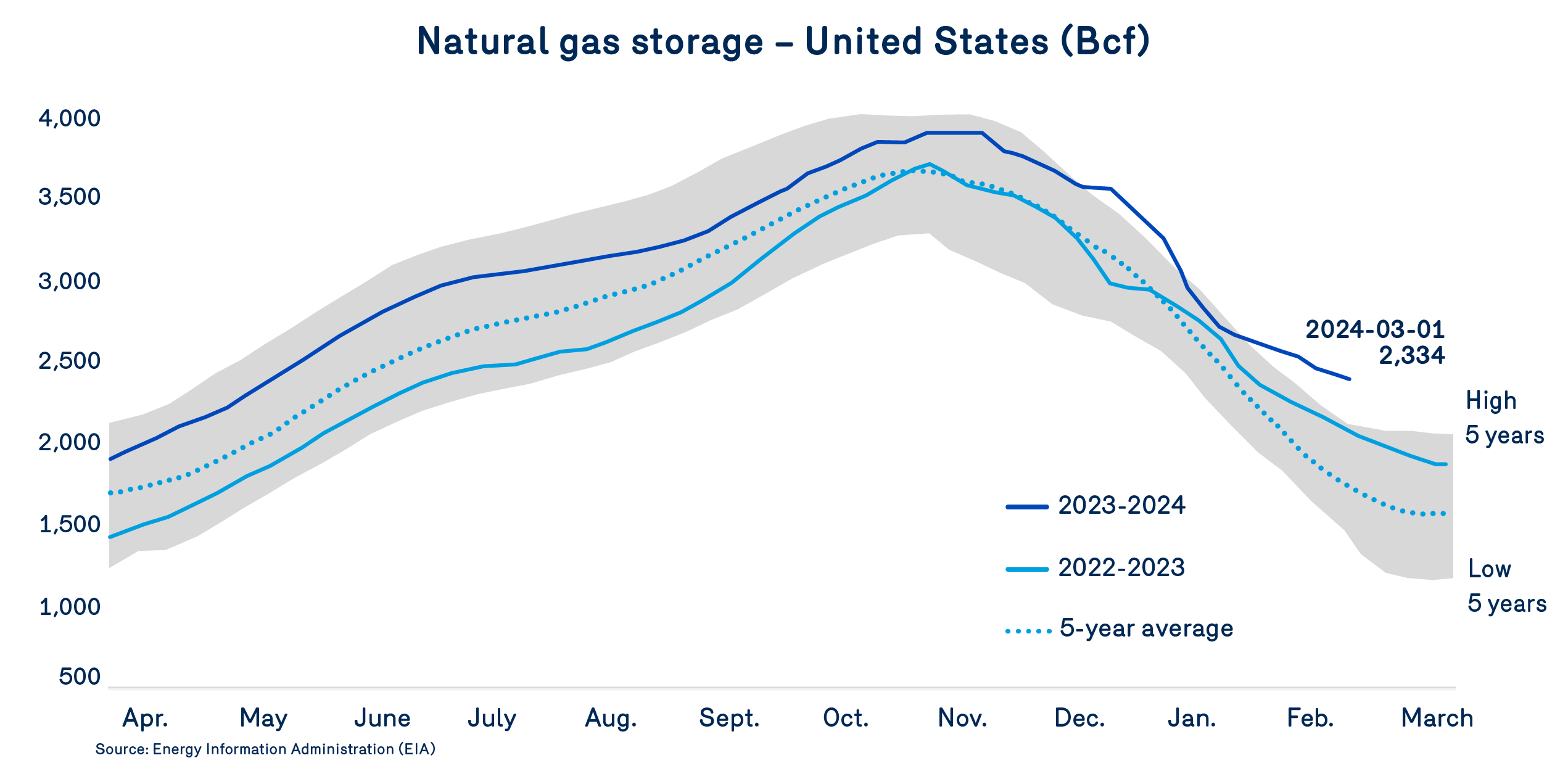

These forecasts are also supported by the latest storage data, which show that current levels exceed historical maximums in a majority of regions in North America. It’s been a long time since this has happened. As of March 1, 2024, total United States storage came to 2,334 Bcf, 14% higher than the five-year maximum recorded on that date.

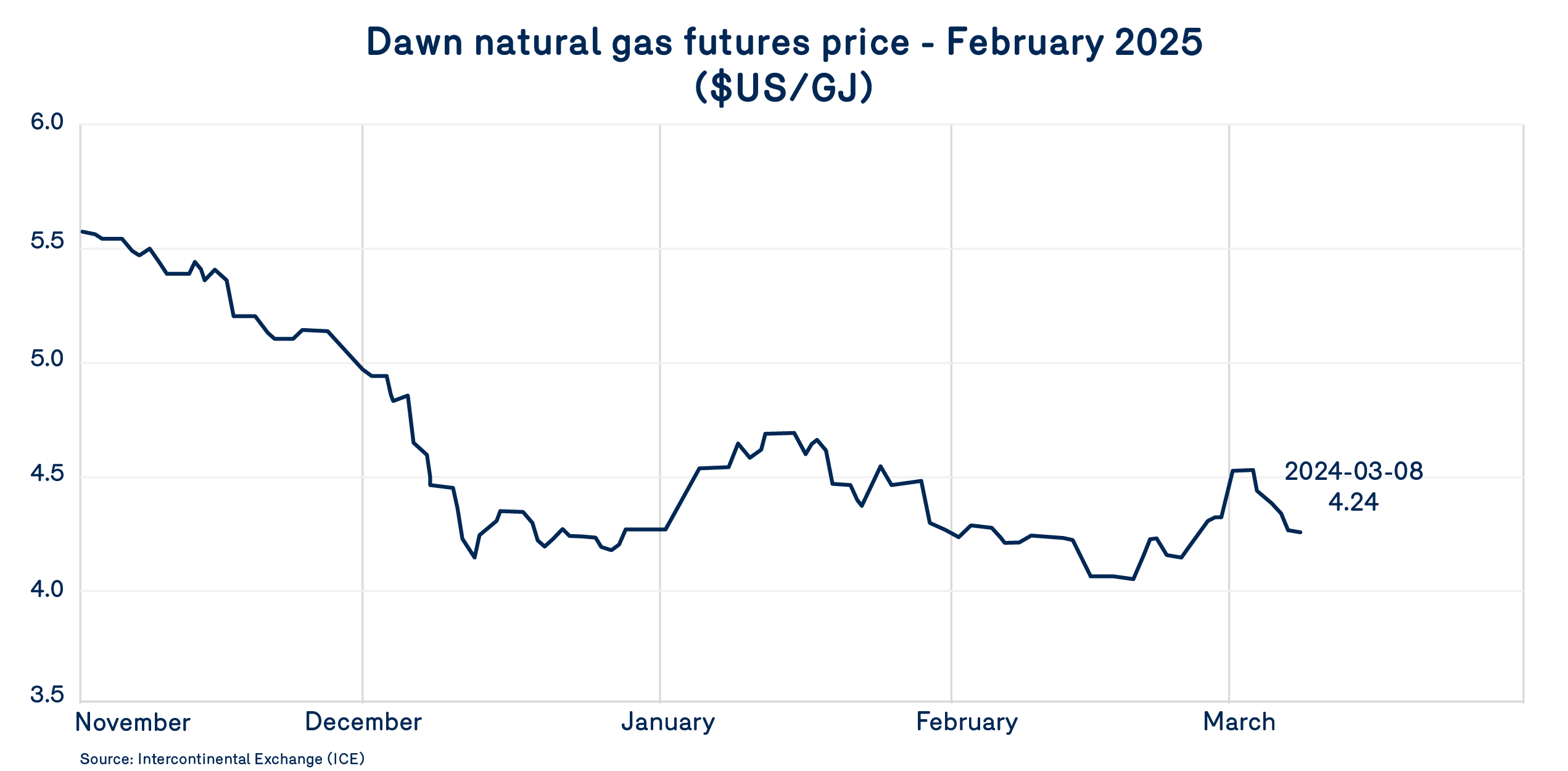

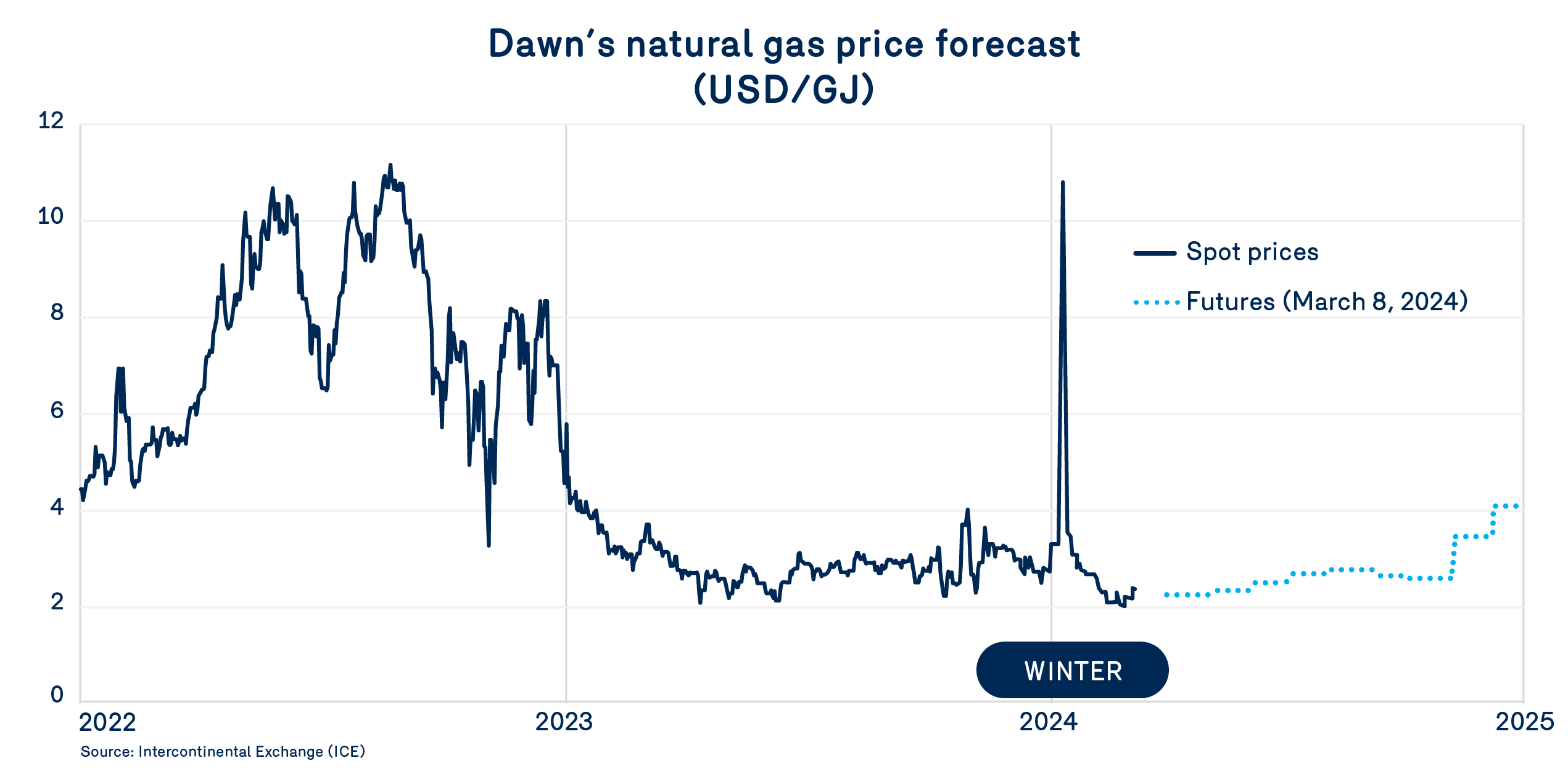

That’s why futures prices are at such low levels. While the price of natural gas in late October 2023 was around $5.50/GJ for February 2025, the price for this key winter month now hovers around $4.30/GJ. While there’s still plenty of time until next February, this level of futures prices fairly indicates the confidence of the gas market towards the fundamentals of North American natural gas supply and demand levels.

The gas market is thus largely likely to maintain natural gas prices in a more sustainable range. As at March 8, 2024, winter 2024–25 natural gas futures prices averaged nearly $4.03/GJ.

In this reassuring market, it’s hard to imagine a spike in monthly prices. Such a scenario appears highly unlikely by November, as the high continental storage levels appear sufficient to meet increases in domestic demand that could occur if the 2024 summer is warmer than normal.

Winter 2024-25 will follow soon after, and with it an expected increase in demand for natural gas liquefaction and the return of the La Niña weather pattern, which brings colder temperatures. We expect total demand to rise. However, at this time, the most recent projections show that production and storage levels will enable the market to overcome these challenges.