Blue Bulletin

Majors Industries

June 2025

Natural gas market conditions

The latest data shows that winter 2024–2025 was among the coldest in recent years. As we mentioned in our last bulletin, the United States hadn’t seen a January this cold since 2014. The month of February also stood out, notably in comparison to the same month in 2024, which was particularly mild. Compared to last year, heating degree days in January and February were +13% and +23% higher than in 2023–2024.

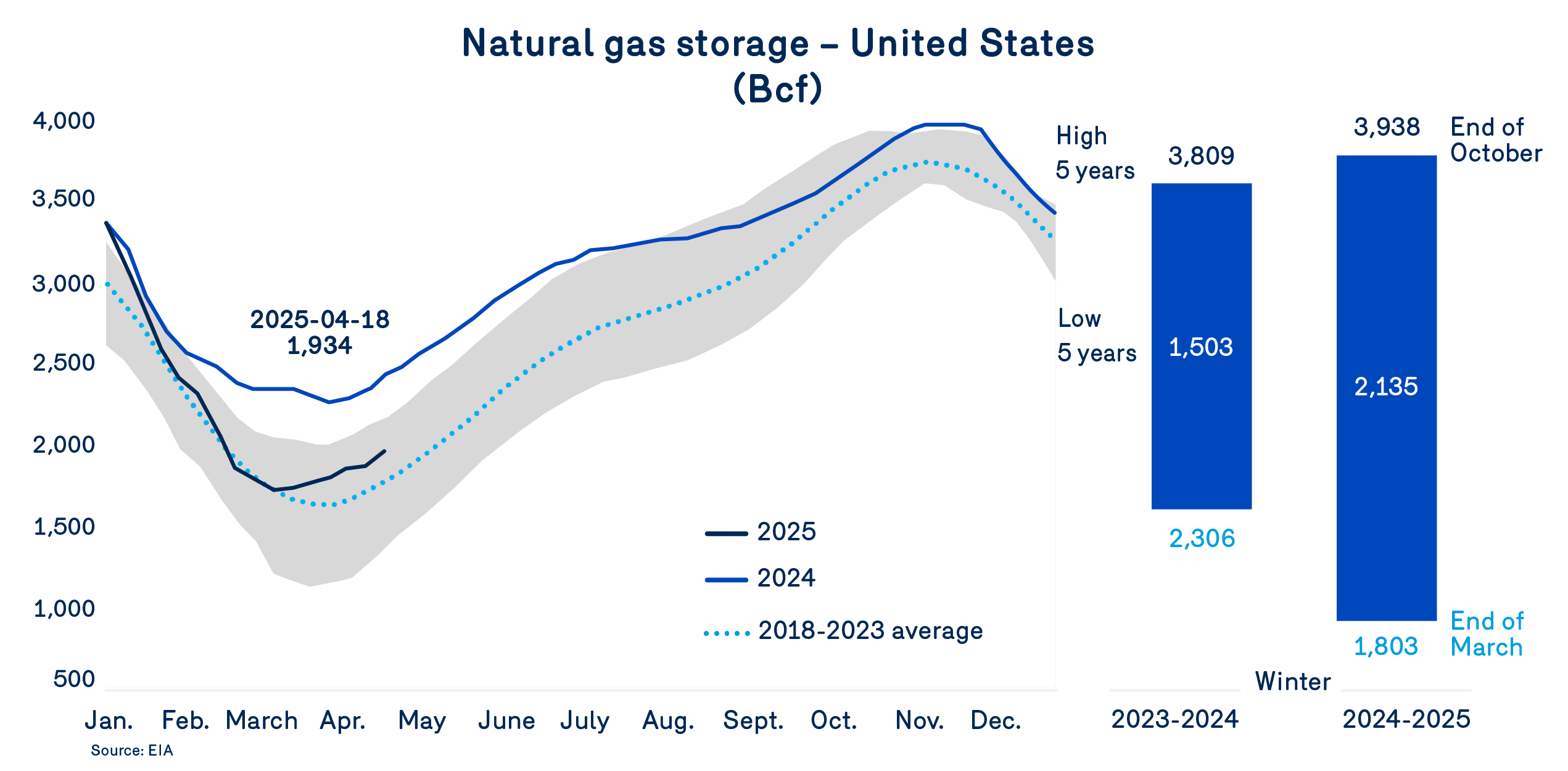

Due to the cold temperatures, demand for natural gas spiked and there were significant storage withdrawals. At the end of October, the total storage level in the United States was about 3,938 Bcf, and by the end of March, it had dropped to 1,803 Bcf. From start to finish, 2,135 Bcf of natural gas was removed from storage to meet winter requirements. Fortunately, warmer temperatures in March and April allowed for strong injections and an increase that brought the total level to above historical averages.

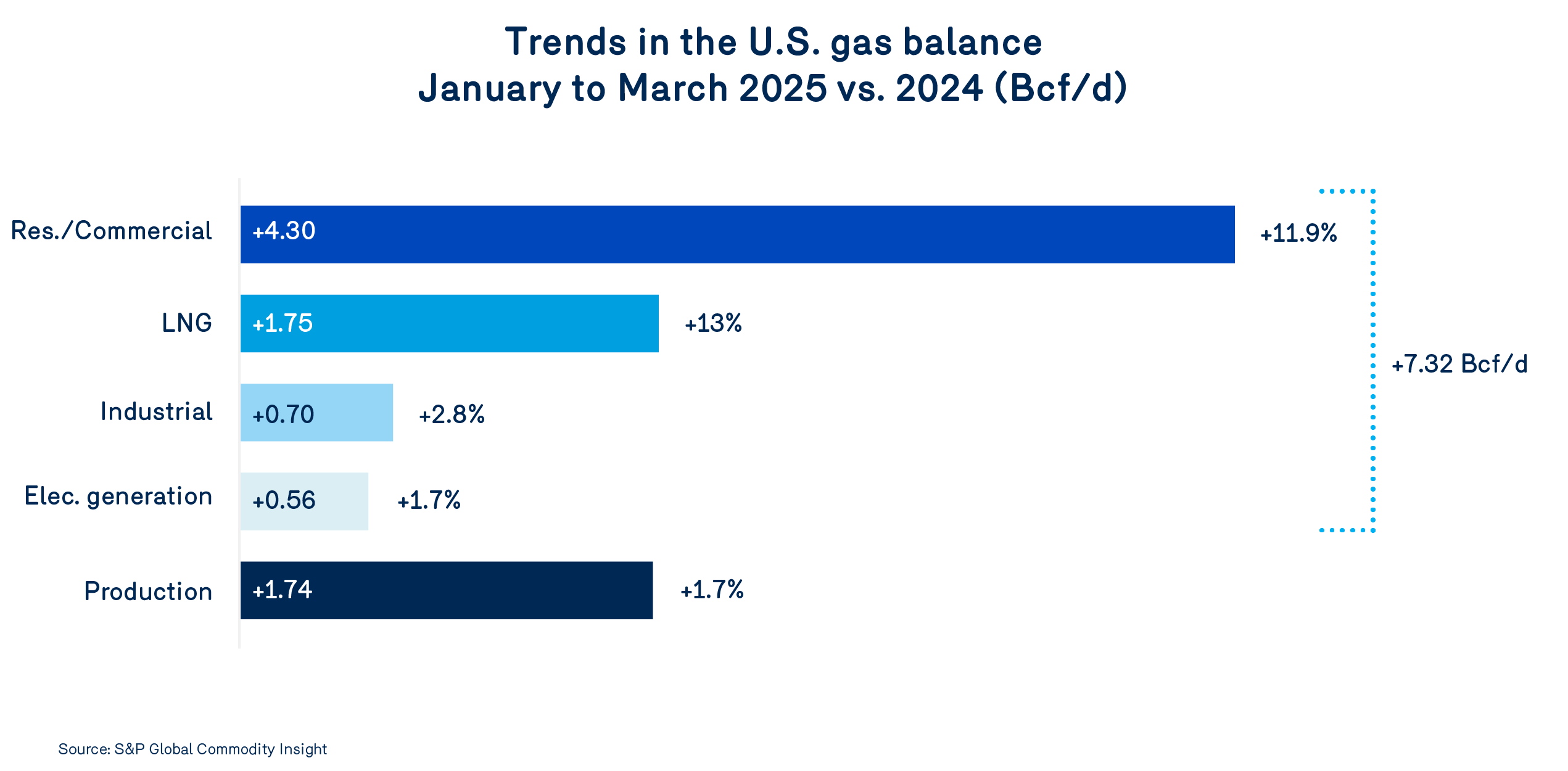

For the first three months of 2025, residential and commercial consumption increased by 11.9% compared to the same period in 2024. Combined with a 13% increase in demand for liquefaction and LNG exports, total demand rose by almost 7.32 Bcf/d over the first three months of 2024.

During the same period, U.S. natural gas production increased by only 1.74 Bcf/d compared to the first three months of 2024. This environment caused prices to rise across all major North American market hubs until warmer temperatures in March and April brought them back below $4.00/GJ.

Market attention is now focused on the summer 2025 period and its impact on the pace of storage injections and, in turn, on natural gas prices. Natural gas demand for LNG production and export is already expected to be about 3.6 Bcf/d higher. On the U.S. domestic consumption front, July 2024 saw record electricity generation driven by soaring temperatures and based on record natural gas use. But we’re anticipating a return to normal temperatures in the summer of 2025, and demand for generation is expected to decline.

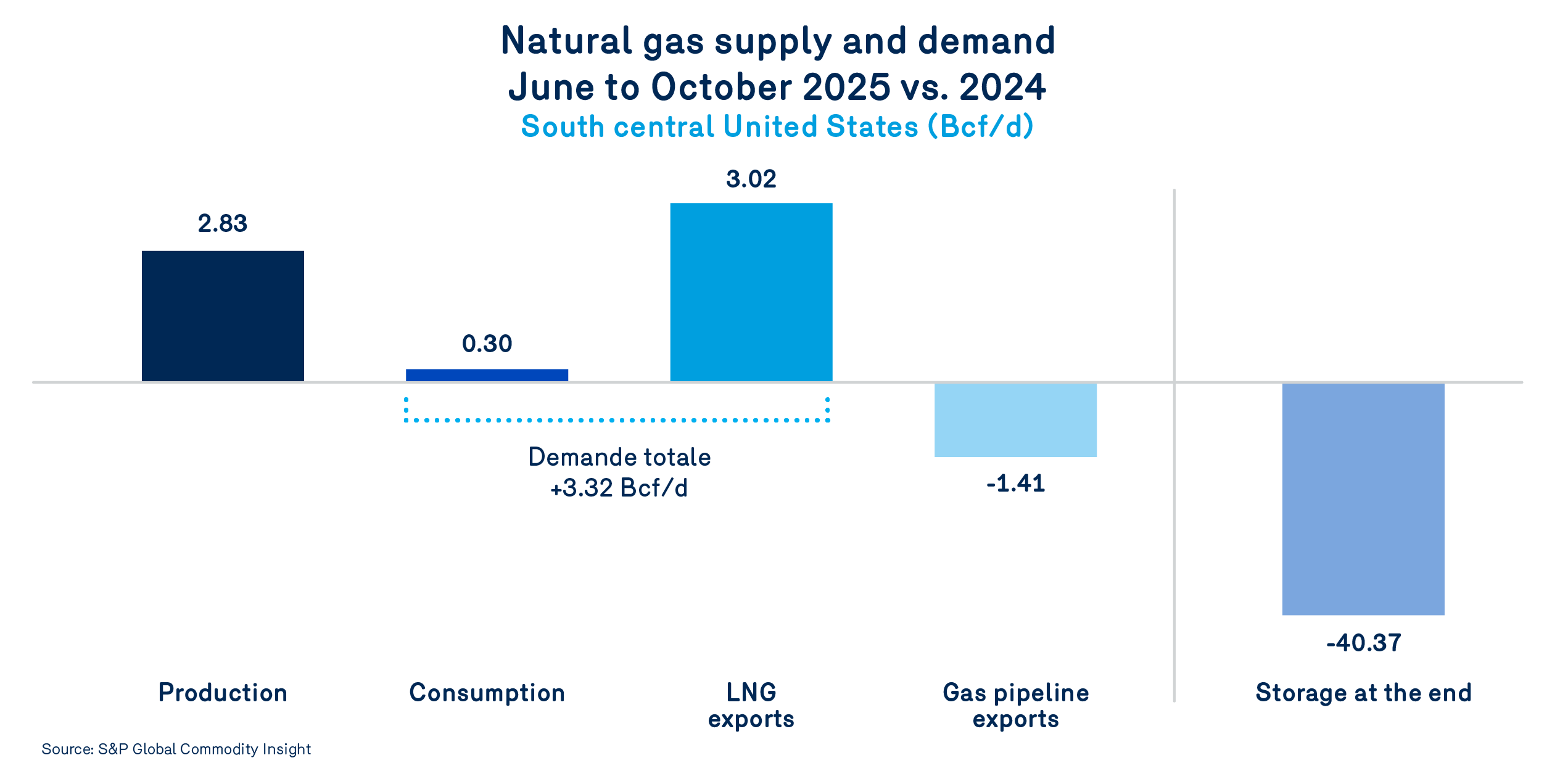

To better understand medium-term price dynamics, it’s helpful to take a closer look at the gas balance in the south-central United States, where key LNG liquefaction and export facilities are located. The most recent forecast from S&P Global Commodity Insights suggests some tension. For June to October 2025, production is expected to increase by 2.83 Bcf/d, and domestic consumption is expected to rise slightly. In addition, LNG exports are expected to increase by more than 3.02 Bcf/d to 15.7 Bcf/d at the end of October 2025.

Consequently, the natural gas balance is fairly tight, which calls for a decrease in natural gas pipeline exports to the southeastern states, including Florida, and a decrease in storage levels. Overall, S&P expects storage to fall by 40.37 Bcf (-4.9%) compared to October 2024, mainly due to lower demand for natural gas for electricity generation.

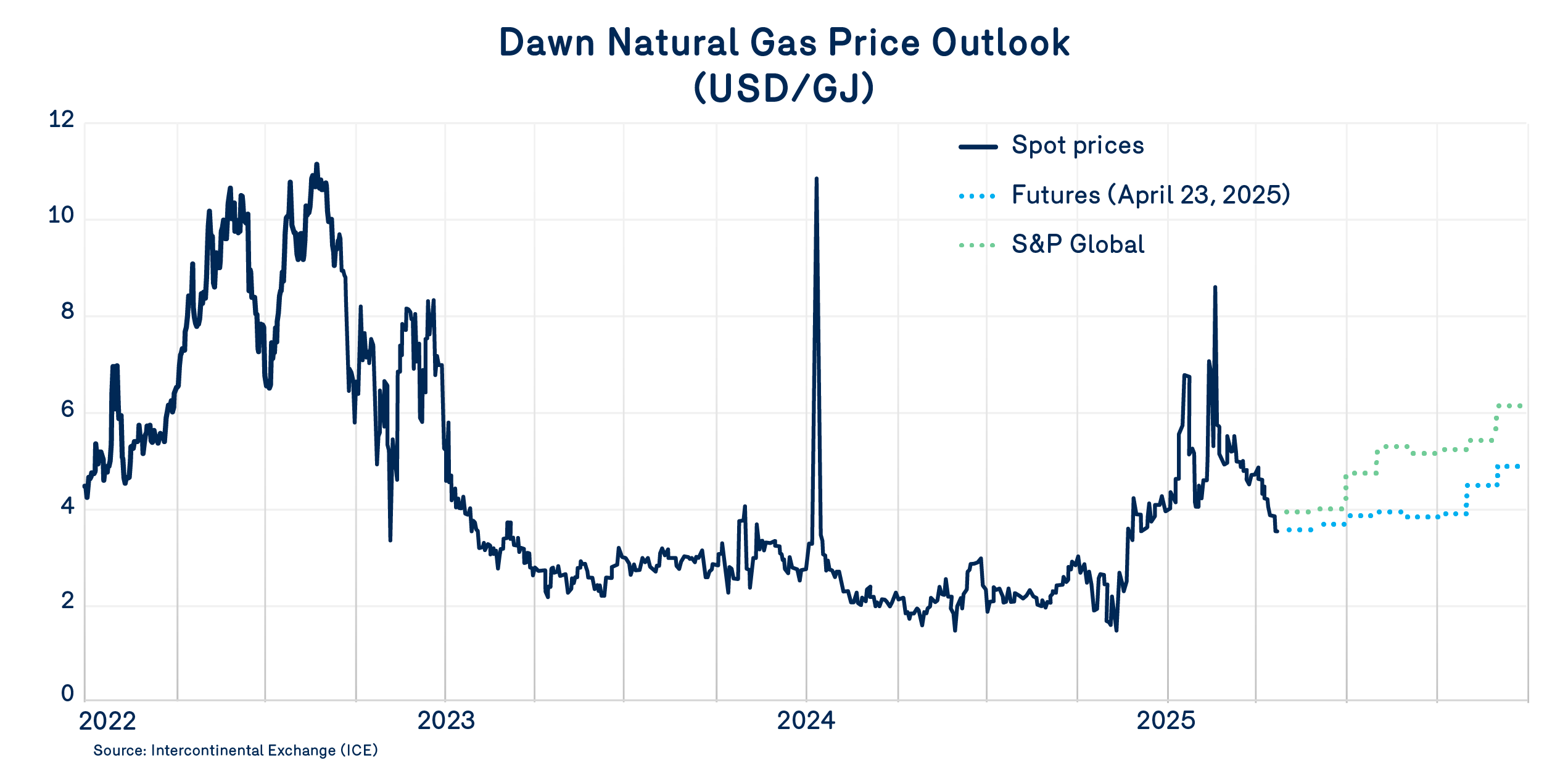

Based on this challenging environment, S&P expects natural gas prices to rebound from June 2025 to the end of the year. But the markets are more optimistic, offering lower futures prices. At the Dawn hub, the natural gas environment is expected push prices to between $5.00/GJ and $6.50/GJ by the end of 2025.

If this type of supply and demand balance were to continue, we can expect the upward trend in natural gas prices to continue through the end of winter 2025–2026. However, it is somewhat premature to speculate on the level of key variables that will determine prices in the coming winter. Let’s wait and see how temperatures pan out this summer and what impact they will have on domestic consumption. On the production side, the projected levels are relatively high. While we can’t rule out a bigger increase, low oil prices could slow the growth in natural gas production associated with oil production.

Even if we take the projected level of LNG exports for granted, there are a number of uncertainties surrounding shifts in supply and domestic consumption. It therefore seems unlikely that natural gas prices will return to under $4.00/GJ in the near term.