Natural Gas Market Conditions

As expected, summer temperatures were above normal in North America. However, the magnitude and duration of heat events came as a surprise, particularly in the southern regions of the US. This context significantly boosted demand for natural gas to power air conditioners.

Strong natural gas consumption used to support electricity, combined particularly with natural gas production that is increasing and more resilient in the face of low continental prices and also regional prices in certain production basins, has put significant pressure on the natural gas market. By reducing the rate of summer injections, storage facilities were able to absorb the shock and contain the potential upward pressure on natural gas prices in key North American markets.

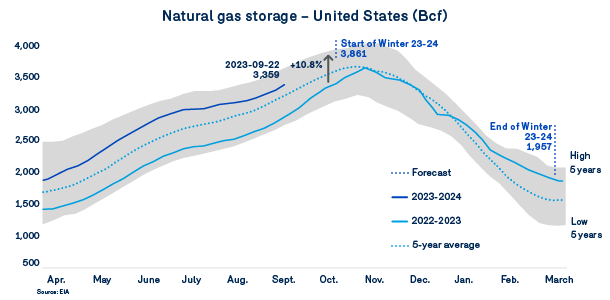

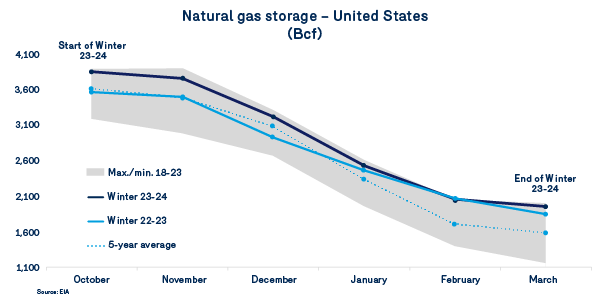

With the summer of 2023 now behind us, above-normal temperatures in October should allow storage levels to rise to a comfortable 3,861 Bcf or so in the US, which is 10.9% above last year’s level at the same date. Such a high level of inventory is not unrelated to the relative weakness in natural gas spot and futures prices for the coming winter months.

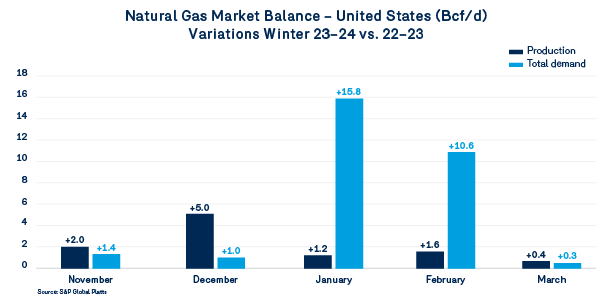

This is a good starting point, but it remains to be seen what winter temperatures will bring. As the La Nina weather pattern has shifted to an El Nino pattern, temperatures are expected to be above normal, with a lower probability of polar vortex. That said, given the relatively warm temperatures in January and February 2023, even a return to normal winter temperatures for the winter of 2023-2024 should mean a return to higher demand for natural gas in the Residential and Business sectors. While production is expected to grow somewhat from last winter, particularly in December, the total US consumption is forecast to increase by nearly 15.8 Bcf/d in January 2024 compared to January 2023.

As a result, the natural gas balance is expected to be a little tighter and will impact the rhythm of natural gas withdrawals from storage in the second half of winter 2023–2024. The difference from last winter is that storage levels at the end of October will be significantly higher. This means that even with a higher withdrawal rate, storage facilities will remain above last year’s levels, or at least well above historical averages.

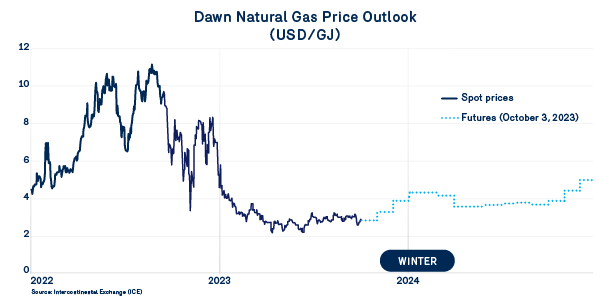

In all, this environment is favourable to maintaining natural gas prices in a relatively low range compared to last winter. As at October 3, 2023, winter 2023–2024 natural gas futures prices averaged nearly $3.95/GJ. This forecast is based on the most recent climate forecasts and may change.

The fundamentals leave little room for a natural gas price spike similar to that of 2022. Unlike the fall of 2022, the high storage levels should be able to absorb any unexpected pressure from natural gas consumption.

The market expects prices to remain within a range of $3.50/GJ to $5.00/GJ for 2024.