Renewable Natural Gas

Et si on parlait gaz naturel renouvelable ?

By Renault-François Lortie

Vice-President, Customers and Gas Supply

The inverted pyramid of energy efficiency: Innovation for decarbonization

By Sami Maksoud Eng., M.Eng., MBA

Senior Advisor, Major Industries

In this article, I revisit the concept of the Maslow pyramid of energy efficiency that I presented in the November 2020 Informa-TECH. With the inverted pyramid of energy efficiency, I integrate the notions of return on investment (ROI) and renewable natural gas (RNG) into the equation to open up new perspectives on decarbonizing buildings.

Solid foundations

As a reminder, the concept of the Maslow pyramid of energy efficiency is based on the idea that an energy efficiency approach must follow a logical sequence to generate tangible benefits. This order is not “cast in stone” and can be adapted to the realities of each project. That said, if, for example, a property manager decides to install a geothermal system in a building before sealing the windows and building envelope, they’re opening themselves up to justifiable criticism.

Innovate with technology…or ideas

The article also explains that innovation can mean new technology, but it can also mean re-engineering the way things are done—in short, getting things done differently or in a different order. This is precisely what the reverse pyramid concept of energy efficiency flows from.

The unique criterion

This concept was born out of meetings with companies that employ an energy manager—a person whose mission is to optimize the company’s energy consumption and ensure the efficiency of the overall system. This professional must respect the profitability criteria to which each project is subject, including an ROI of 3 years or less. I refer to this requirement as the “unique” criterion. In reality, there are others, but if the project does not respect this first one-dimensional evaluation, it will not move on to the full evaluation stage based on its response to the needs of the company. However, knowing that project costs rise faster than energy costs, sooner or later the person responsible for the plan will have exhausted all measures to comply with this 3-year rule.

New opportunities thanks to RNG

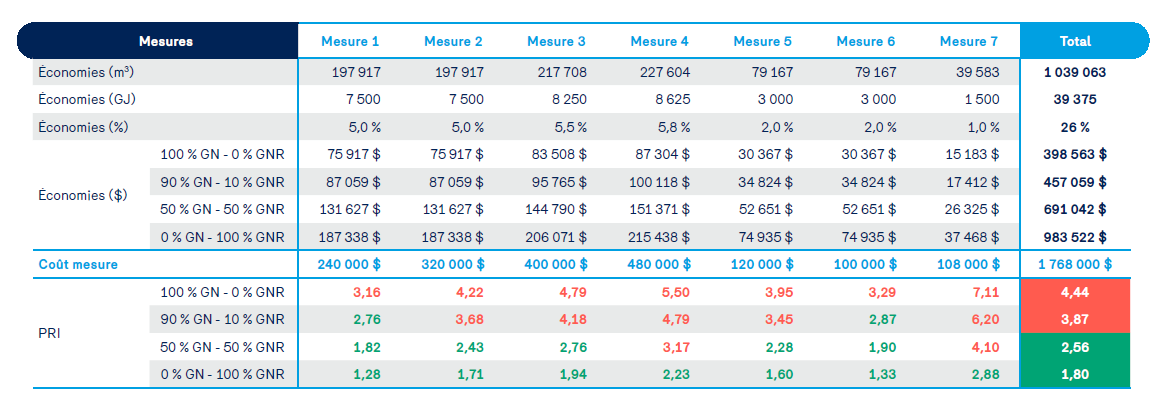

The reverse pyramid of energy efficiency is therefore based on the idea that once all feasible and/or cost-effective decarbonization solutions have been exhausted, it may be time to consider converting all or part of traditional natural gas consumption with renewable natural gas (RNG). Why? Because switching to RNG is a way to rethink the project as a whole and open up new possibilities, as illustrated in the table below.

Reducing the ROIs…

In the first scenario presented in the table below – using 100% traditional natural gas with no RNG input (100% NG – 0% RNG scenario), the unique criterion doesn’t allow for the deployment of any energy efficiency measures. This is because all measures have an ROI of more than three years (see the ROIs in red). In contrast, the last scenario (0% NG – 100% RNG) doubles the amount of savings and significantly reduces the ROIs because the costs of these measures are unchanged. There is also a range of possibilities to be considered between the two extremes.

Calculation assumption - December 2023:

- Annual consumption of 150,000 GJ or +/- 3.95 million m³/year

- Traditional NG = $4/GJ

- RNG = $19.12/GJ

- CATS = 10¢/m³

- Transport/Balancing/Distribution = 13¢/m³

… and the RNG cost premium

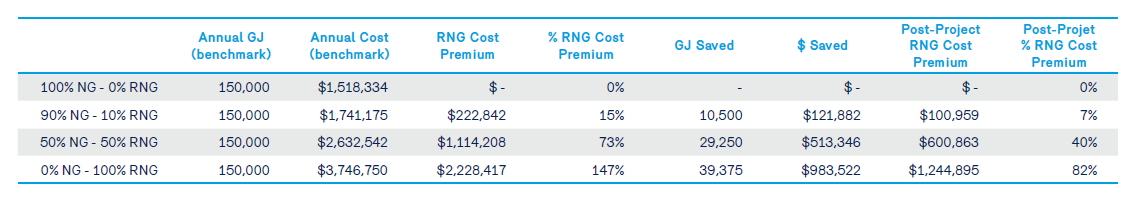

However, as mentioned in the previous section, the RNG cost premium significantly increases monetary savings and therefore provides leverage. As such, to properly assess the cost premium of RNG when integrated into an energy-saving project, it’s important to look at the final result as a whole in relation to the initial situation. In other words, you must compare a “100% efficient RNG” scenario to a benchmark scenario using traditional natural gas.

The table below summarizes the status of each scenario, including only the savings of the selected measures (ROIs of less than 3 years).

You can therefore see that it’s a mistake to assess the RNG cost premium at day zero without taking into account the energy efficiency potential. In this case, the RNG cost premium shifts from 147% at outset to 8265% post-project. Combined with an initiative to raise capital for asset maintenance, this type of project can improve your energy efficiency record while enabling the switch to 100% renewable energy at a lower cost.

An adaptable model

The numbers presented are from a hypothetical case. Although they may vary depending on the situation, the calculation remains the same. The key takeaway is that switching to RNG would allow this customer to proceed with their project, whereas the status quo using traditional natural gas would not. In some cases, a client will exceptionally agree to undertake a project with a longer ROI and consume RNG moving forward. It all depends on the initial objective. If the goal is to go 100% renewable, considering RNG earlier in the process can generate opportunities for energy efficiency.

Thinking and doing things differently

Whatever the situation, if the ultimate goal of the project is to decarbonize a building (or building stock), then doing nothing because all feasible and/or cost-effective measures have been exhausted—and looking only at the “simple” RNG cost premium—is not a solution. By applying the inverted pyramid model and migrating all or part of traditional natural gas consumption to RNG, you can implement energy efficiency measures that didn’t initially meet the profitability criteria. Of course, switching to RNG means higher operating costs, so you need to consider how you can make the project cost-effective under these conditions. The bottom line is that in order to advance a decarbonization project, the team needs to innovate and think differently. As Einstein said, the definition of insanity is doing the same thing over and over and expecting different results.

To sum up

- Opting for 100% RNG consumption from the outset made it possible to complete a global project with an ROI of less than 3 years and to improve its energy efficiency (savings of 26%)

- Because these savings are ongoing, the dollars saved reduced the annual RNG cost premium from 147% to 8265%.

- The timing of the decision to decarbonize is important and will influence the selected projects. If you wait until after the project, deciding to reduce your needs before switching to decarbonized, more expensive energy, your options will be very limited.

- For the purposes of this exercise, we only compared the extreme solutions (0% vs. 100% RNG). However, there are a range of intermediate options that can be considered.