Natural Gas Market Conditions

Winter 2023–2024 may be just underway, but it’s already shaping up to be the winter with the lowest natural gas prices in recent years. Although it’s a bit early to confirm this as fact, several indicators corroborate the singularity of 2023 as a whole and of the 2023–2024 winter period.

To the surprise of many, the gas market benefitted from a particularly resilient natural gas production sector throughout the year. Low natural gas prices, increasing production costs and a slowdown in drilling activity didn’t alter the pace of natural gas production in the US and Canada.

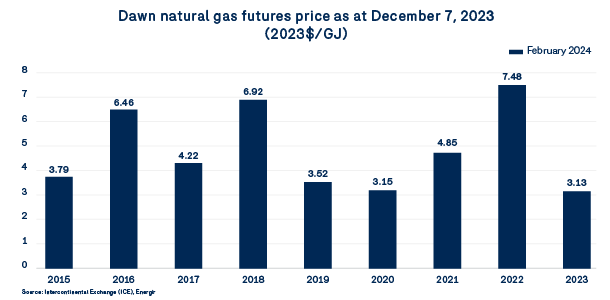

As a result, and despite strong demand for natural gas from the electricity production sector, natural gas spot and futures prices have remained at historically low levels—especially when expressed in constant dollars. For example, as aton December 7, 2023, the market’s February 2024 futures price was $3.13/GJ. In comparison, the February 2021 futures price as aton December 7, 2020, expressed in 2023 dollars, was $3.15/GJ.

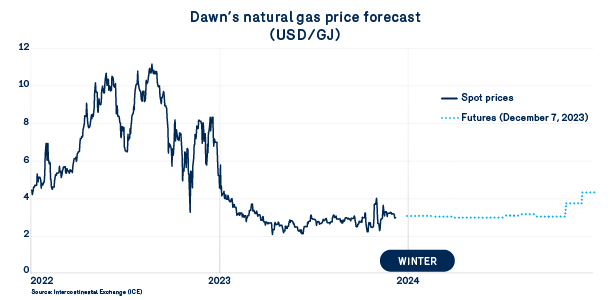

Prices continue to reflect a balanced market. Ever since the above-normal temperatures in January and February 2023, the market has been built on a balance of supply and demand that’s particularly advantageous for buyers. Low spot and futures prices are clear evidence of this favourable climate.

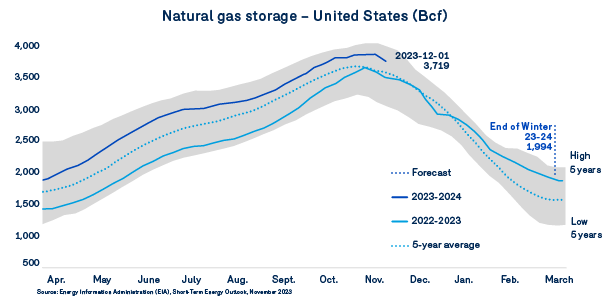

One of the key indicators used to analyze the winter gas market is, without a doubt, storage levels across the United States. On December 1, 2023, the overall level hit 3,719 Bcf, which is 7.3% higher than last year.

This is a great starting point for early December. All that remains to be seen is what winter temperatures will bring. As noted in the last bulletin, now that the La Nina weather pattern has shifted to an El Nino pattern, temperatures are expected to be above normal, with a lower probability of polar vortex.

According to the US Energy Information Administration’s (EIA) latest forecasts, American natural gas production should grow by +3.3 Bcf/d compared to last winter, as opposed to just +0.8 Bcf/d for total demand. In this context, the low futures prices make more sense. With such a high storage level in early winter, the EIA projects this level to be at around 1,994 Bcf by the end of the winter, almost +9% higher than the excellent level at the end of March 2023. What could be better?

Therefore, the natural gas environment is largely favourable to maintaining natural gas prices in a relatively low range, at least compared to last winter. On December 7, 2023, winter 2023–2024 natural gas futures prices averaged nearly $3.15/GJ for the last four months of the season.

In this reassuring and optimistic market, it’s hard to imagine a sharp rise in prices in the coming months. Over the entire period, such a scenario seems highly unlikely; the high level of continental storage should be able to absorb any unexpected pressure from consumer demand.

However, over short periods of time, fluctuations in temperature can create significant price volatility in more fragile regional markets. One such example is the New England market, where natural gas needs rely on natural gas sourced from the Appalachian region and on imported volumes of liquid natural gas (LNG).

For 2024, the market now expects molecule prices to remain around $3.15/GJ before experiencing a significant rebound in early winter 2024–2025. Markets are already anticipating the coming increases in liquefaction capacity. Stay tuned!