Gas markets outlook heading into winter

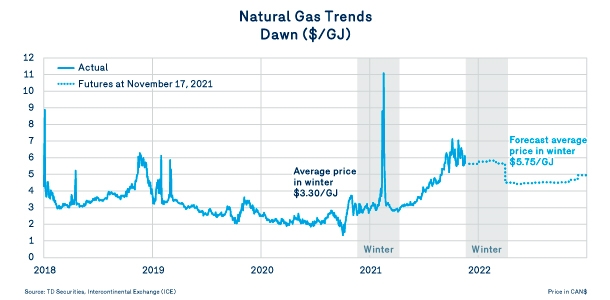

Since last May, growing demand for natural gas in North America has led to a significant rebound in continental natural gas prices. While production was slow to recover, US liquefaction of natural gas for export to the rest of the world was operating at full capacity, putting pressure on continental spot prices. Bearing in mind the effects of the February 2021 polar vortex, gas markets adjusted to this shift in supply/demand balance and quickly drove winter prices for 2021–2022 to historic highs.

This has been a roller coaster ride as we await actual data on storage levels and production.

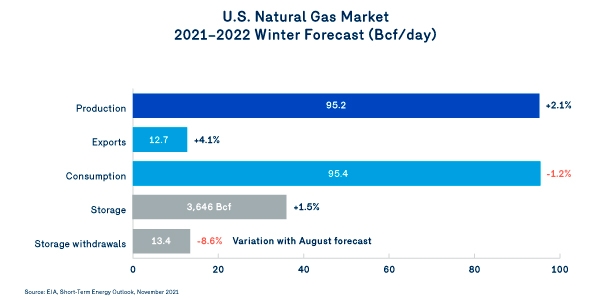

By mid-November, the most recent forecast showed that the gas environment is improving from the previous August forecast.

This improvement is expected to provide some relief to prices. Although the forecast for US natural gas exports was revised upward (+4.1%), that of domestic consumption was revised downward (-1.2%). More importantly, the US natural gas production forecast for the current winter is 2.1% higher than the August forecast.

This set of forecasts results in higher early winter storage and sharply lower total anticipated withdrawals (-8.6%) than expected. All we need now is for temperatures to tell the rest of the story.

In the meantime, the markets are still feverish. Natural gas prices are cascading and remain at high levels, higher than the current supply/demand balance can explain.

For the entire winter of 2021–2022, the average market price is $5.75/GJ.

These forecasts indicate a substantial increase in the price of natural gas for the winter of 2021–2022 compared to winter 2020–2021. This increase could very well be mitigated in the event of warmer temperatures and a more favorable gas environment.

Dawn's price situation

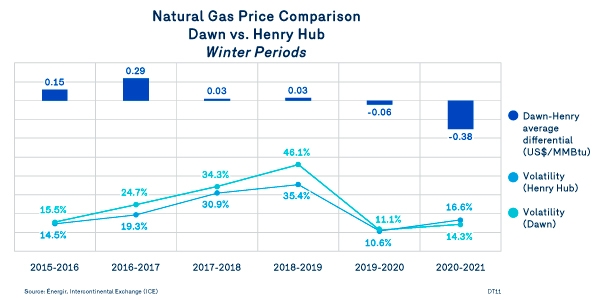

It's interesting to note a few statistics that show differences in the price of natural gas from one region to another. While natural gas prices in the South-Central United States (where Henry Hub is located) are more responsive to international price movements, prices at Dawn appear to benefit from better connectivity with production from the Western Canadian basin and the Appalachian basin in the Eastern US This would result in relatively lower and volatile prices at Dawn.

Since the winter of 2019–2020, there has been a significant reduction in the natural gas price differential between Dawn and Henry Hub. The following graph shows that over the past winter, the average price at Dawn was US$0.38/MMMBtu lower than at Henry. In addition, price volatility in Dawn was also slightly lower than at Henry Hub, at 14.3% versus 16.6%.

Is this a new trend, a new paradigm for the Dawn hub? Or is it simply an extraordinary situation preceding an eventual return to normal? Perhaps it's a little too early to tell. However, one thing is certain: The North American gas market now appears somewhat less monolithic or homogeneous than it did only a few quarters ago, and the Dawn hub appears more resilient to some continental challenges.

Read the other subjects from this bulletin

Energy Management System

Regulatory Update

Carbon Market and RNG Certification