Natural gas: Current market conditions

Since last spring, energy markets have been heavily affected by the conflict in Ukraine and its impact on the economic equilibrium in Europe, through a significant increase in the price of energy, including natural gas.

With maximum liquefaction and export capabilities already reached, the North American natural gas market responded to these shocks with some moderation. These international pressures were followed by cold temperatures and a sharp drop in natural gas stocks. Against that backdrop, North American natural gas prices rose to high levels as early as February, with markets anticipating they would remain high for several months.

Actual summer data shows that natural gas prices have indeed stayed at record highs, but for slightly different reasons than the market expected.

Firstly, unusually warm temperatures kept natural gas prices at such high levels. Throughout the summer, average temperatures in most parts of the United States, including Texas, remained above normal and drove power demand for air conditioning.

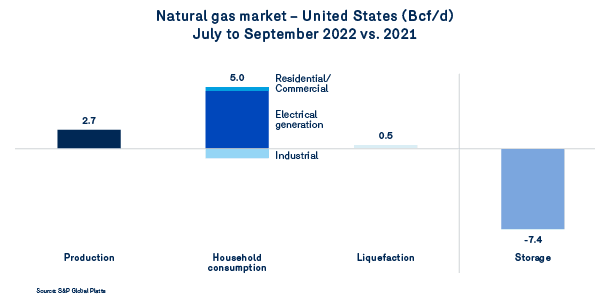

For the July to September period, U.S. natural gas consumption increased by 5.0 bcf/d (or 7.1%) compared to the same period in 2021. This is well above U.S. production during the same period.

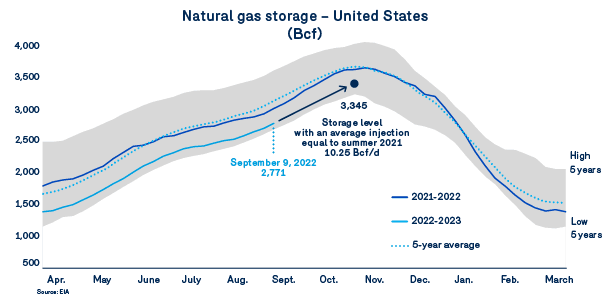

The result is a supply/demand balance that pushes natural gas spot prices to historic highs and reduces the level of natural gas storage injections ahead of winter 2022-2023. However, this past winter has left storage well below historical averages. With only a few weeks left before the withdrawals start, the storage level was around 2771 Bcf as of September 9, about 7.4% below its 2021 level.

Already close to the minimum in early April, natural gas stocks couldn’t really recover as quickly as the market had hoped. Despite the temporary closure of a liquefier in Texas that reduced demand for natural gas and provided hope for a higher injection, hot temperatures raised demand for natural gas, which could have been used to further raise storage levels.

More than ever, storage injections add to domestic consumption and exacerbate tensions in spot and future markets. Clearly, high natural gas prices reflect the market sentiment that U.S. storage will inevitably be near minimums in early winter 2022-2023, and will remain so for the rest of the winter.

Even at last year’s rate of about 10.25 Bcf/d, the level expected at the beginning of November 2022 would be just over 3,300 Bcf and at the lowest point of the last 5 years. However, while this level of storage remains largely sufficient to support production in meeting winter needs, it remains a source of market concern until temperatures are reached and real demand is observed.

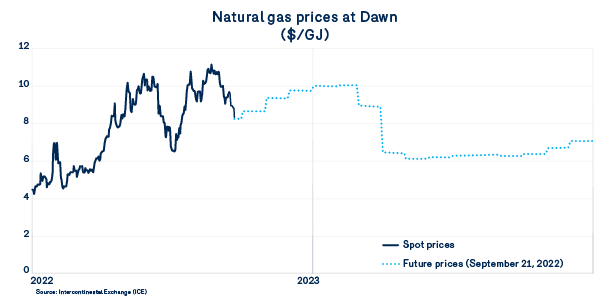

Recent developments in natural gas prices in spot and futures markets undoubtedly reflect these concerns and those arising from a summer that turned out to be much hotter than usual. As of September 21, the markets offer prices at Dawn ranging from $8/GJ to $10/GJ for spot purchases and forward prices by the end of February 2023. This forecast could change positively for customers in the event of above-normal real temperatures or higher production.

Prices are highly volatile and will respond quickly to colder-than-expected winter temperatures. The natural gas demand for November and December will play a key role in market sentiment for the more critical months of January and February.

Next up is production. Price hikes and increased productivity contributed to increased drilling. Everyone is expecting U.S. production levels to exceed 100 Bcf/d by late spring. At this level, production will be better positioned to contain domestic consumption and international pressures. In this regard, current liquefaction and export capacity will remain stable until mid-2024. So in North America, it’s all about production and temperature.