Natural gas price outlook

The North American natural gas market was hit by a tsunami over the past year.

- First of all, the milder temperatures in winter 2019–2020 drove natural gas prices to historically low levels, forcing a majority of gas producers to reduce capital expenditures and thus minimize the impact of the decrease in revenues on their balance sheet.

- Next came a pandemic that led to a sharp slowdown in the global economy spurred by a collapse in demand and prices for petroleum products. In the United States, more than elsewhere, oil production fell sharply, causing a drop in natural gas production.

A look back at prices in 2019-2020

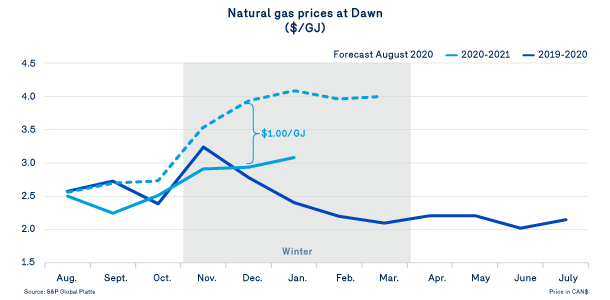

Although the effects of these shocks will continue to be felt on the supply/demand balance in 2021, the gas market nevertheless ended 2020 with prices well below the forecasts made at the height of the storm. In December 2020, actual prices averaged $2.93/GJ, whereas last August, markets were forecasting prices around $3.93/GJ, a difference of $1.00/GJ between forecast and actual.

Temperatures can account for these actual prices below forecasts . For the months of November and December, actual heating degree days in the US Midwest were 17% and 10% lower, respectively, relative to the weather forecast issued in August 2020. Comparable differences were also observed in other Northeastern regions of the continent. In a context of high storage levels, the milder-than-expected temperatures early in the winter had an undeniable downward effect on spot and future prices for the rest of the season.

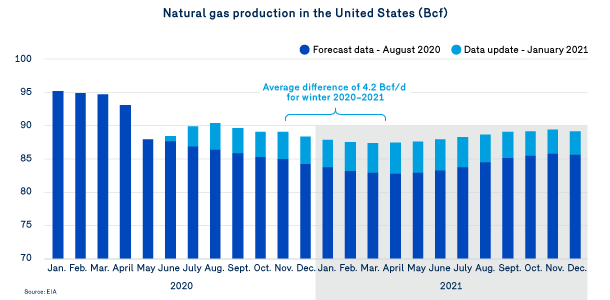

Production stronger than expected

As shown in the graph to the left , actual natural gas production levels were higher than expected just a few months ago. Despite the disruptions in the oil and gas markets, the Energy Information Administration (EIA) now estimates that production levels in winter 2020–2021 will be about 4.2 Bcf/d higher than it predicted last August, a 5% improvement.

Demand driven by liquefied natural gas (LNG)

On the demand side, the EIA also revised its forecast for US natural gas consumption upward by 1.4 Bcf/d, due in part to continued growth in demand for liquefaction and export purposes.

In short, a smaller increase in demand relative to supply, combined with high storage levels , accounts for the softening of natural gas prices seen on the markets.

So it appears the gas market has been more resilient to cyclical and structural disruptions than initially estimated by the markets and experts. Of course, the storm has not yet passed.

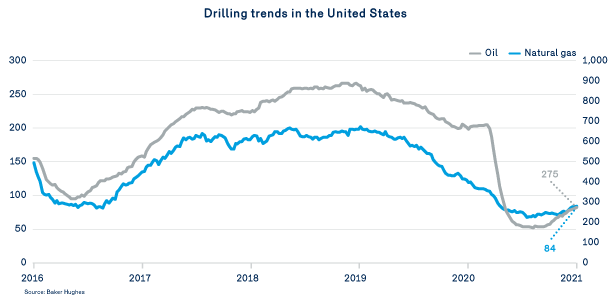

- On the one hand, despite a recent rebound by WTI above US$50/barrel, oil and associated natural gas production will still take some time to fully recover, given that drilling activity is still far from early 2020 levels and the global economic environment remains fragile . However, experts anticipate an increase in associated natural gas production volumes toward the second half of 2021.

- On the other hand, prudence and balance sheet improvement remain the name of the game in 2021 for gas producers who are now operating in a more demanding financial environment. The resulting reduction in investments is forcing these producers to focus even more on increasing productivity and to use an effective strategy as a safeguard against bouts of low natural gas prices, particularly in the Appalachian region. The current upward revision of natural gas production forecasts suggests that producers are working successfully to meet this challenge, but much remains to be done.

Natural gas price forecasts

In the short term, it's the actual temperatures between now and winter's end, their effect on natural gas demand and the level of storage withdrawals that will give a first indication of the gas market's mood over the next few quarters. In the medium term, and in the context of sustained demand, it's the outlook for natural gas production levels that drives discussion and guides the forecast for natural gas prices on the markets.

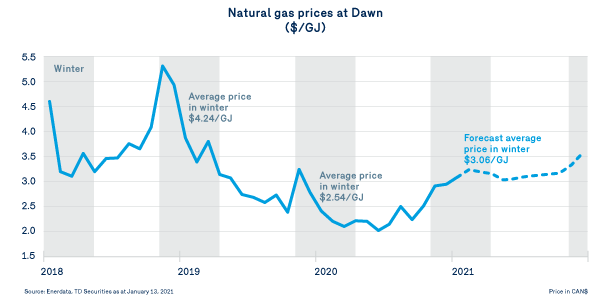

As at January 13, 2021 , the markets anticipate a price of $3.06/GJ for natural gas at the Dawn hub for winter 2020–2021 and $3.17/GJ for 2021 as a whole.

These prices represent significant increases over the actual prices recorded in previous periods. However, they are significantly lower than most forecasts made before the onset of winter and are well within historical averages.

Read the other subjects from this bulletin

News - Studies and implementation program

Update on the renewable natural gas (RNG) file

News - Cap and Trade System

Launch of the new Customer Space