Natural Gas Market Conditions

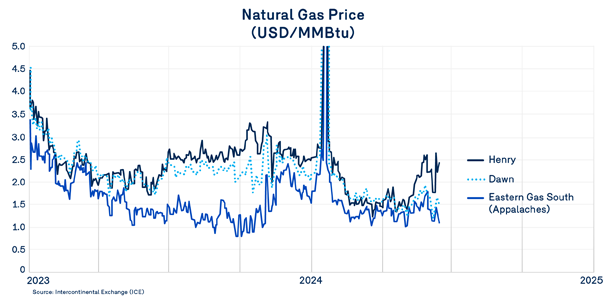

Temperatures over the past winter have left natural gas prices near historic lows across all areas of the continent. However, since late May, some natural gas fundamentals and summer temperature forecasts for the south-central United States in particular appear to herald the start of a sustained rise in natural gas prices.

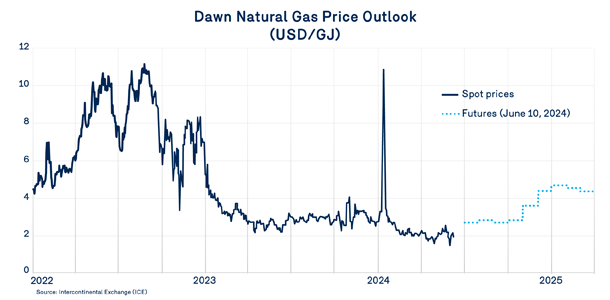

At the moment, the hotter temperatures likely to spur demand for air conditioning are mainly being felt in the southernmost areas of the continent. Further north, prices at the most important hubs have been slow to reach the Henry Hub benchmark. This is the case in particular at Dawn, as well as at the Eastern Gas South hub in the heart of the Appalachians. The prices at both these hubs are currently fluctuating within a lower range than the Henry Hub price.

In the case of the Appalachian hub, the price gap shows an imbalance between production and domestic demand, including demand for the replenishment of storage facilities. Until a drop in production restores the equilibrium, prices will remain low and volatile in this important region. The Dawn price is certainly being influenced by this imbalance and the abundance of natural gas at storage sites in eastern Canada.

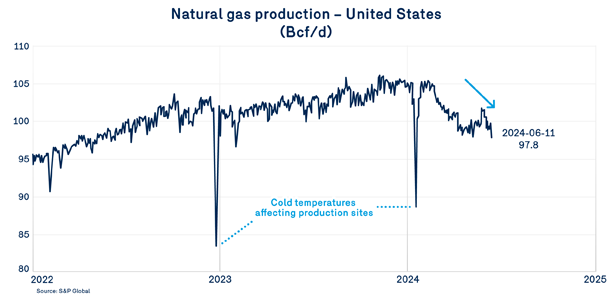

These differences that favour the northern hubs should eventually subside as production levels fall and a more sustainable equilibrium price for producers is restored. Efforts to achieve this have actually been well under way since the start of the year, with production falling from about 105 Bcf/d to about 98 Bcf/d in early June.

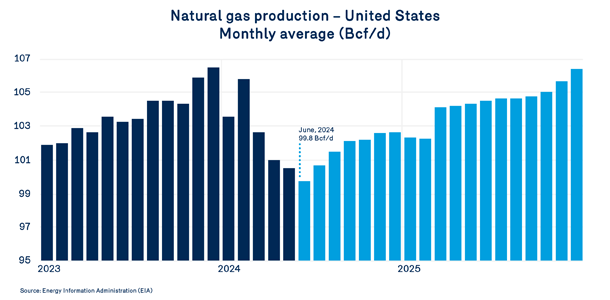

Fortunately, according to the latest forecasts from the Energy Information Administration (EIA), this significant production correction seems to have bottomed out. Based on these forecasts, total production for the country as a whole is expected to return to its record December 2023 level by late 2025.

We know that most of this increased production will be realized in the basins further south, near the liquefaction facilities where demand is expected to grow in the coming quarters. The Appalachian basins don’t have the transportation capacity to increase the natural gas supply to these liquefaction facilities to the south, so their production will rise more slowly. More than ever, their growth potential is linked to changing natural gas demand from the Midwest and demand channelled by the Dawn hub.

In short, while the gas market certainly appears tighter, natural gas prices are nevertheless likely to be driven upwards within a range that should be more sustainable for producers. As at June 10, 2024, winter 2024–2025 natural gas futures prices at Dawn averaged nearly $4.33/GJ, up $0.30/GJ from the outlook in the last bulletin.

The high storage levels across the continent appear sufficient to contain any increased demand for household consumption should the summer of 2024 end up being hotter than normal.