Express Blue Bulletin

New rates for fall 2024

Énergir’s proposed new rates were filed with the Régie de l’énergie on May 10 and are currently awaiting approval, with an intended application on October 1, 2024.

Learn more about our price changes in each section:

Price of Énergir's Services

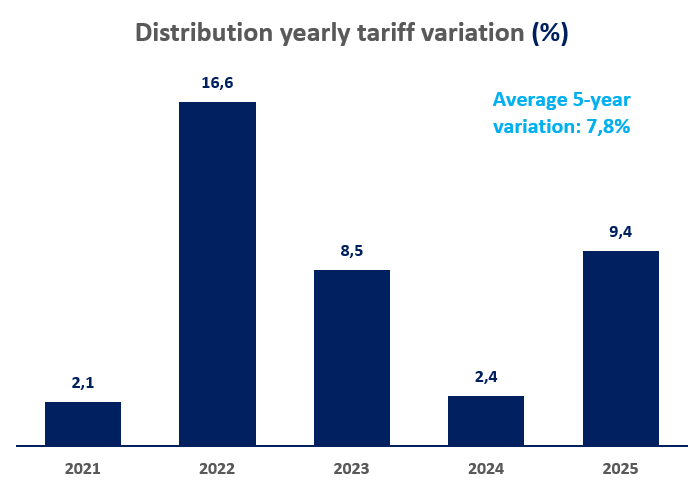

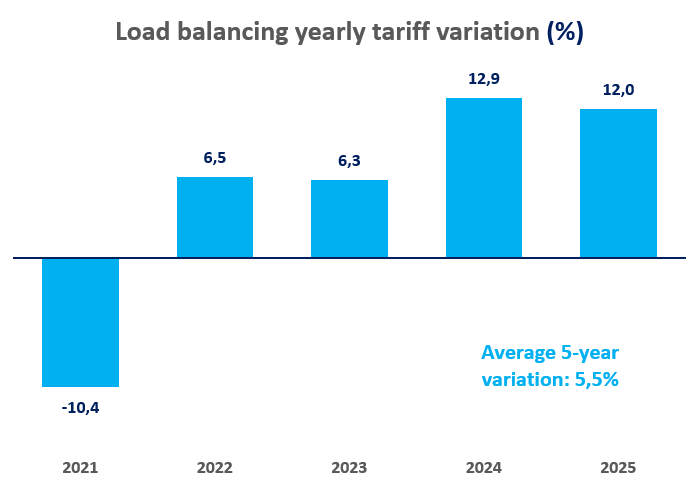

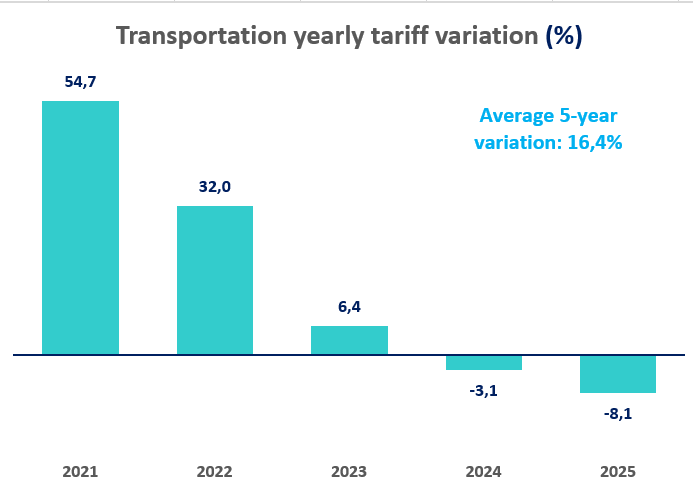

Overall, for all of Énergir’s services, the 2024–2025 rate case results in a rate increase of 7.65% or $78.1M, broken down as follows:

- 9.4% increase in distribution rates

- 8.1% reduction in transportation rates

- 12.1% increase in load-balancing rates

- 50.4% increase in CATS inventory adjustments

- Addition of RNG socialization rate

Énergir’s distribution rates for 2024–2025 are up $63.6M. This increase can mainly be explained by:

- Declining volumes, mainly in the small and medium-sized volume market, have meant lower revenues ($16.2M). The decline is partly due to the economic situation. Note that Énergir is aiming for carbon neutrality by 2050. This will be achieved through a number of initiatives, including increasing energy efficiency and converting natural gas users to the gas from renewable sources (GRS)-electricity dual-energy solution. Both these initiatives will have a direct impact on distributed volumes and their purpose is to reduce natural gas consumption, thereby contributing to the energy transition. Énergir expects to reduce its volumes by 9% by 2030 (in relation to the 2022 level) and by 45% by 2050.

To soften the rate impacts associated with declining volumes, Énergir is currently considering a new, more permanent distribution rate structure that will maintain revenues. Focusing on revenue rather than volumes will limit future rate increases for the benefit of all customers. Énergir plans to file evidence in the fall of 2024, in file R-3867-2013. - The change in net deferred expense accounts (DEA) balances related to temperature and wind rate stabilization ($14.4M). A warmer than average winter in 2023-2024 resulted in less revenues than anticipated.

- Operating expenses and other components of future employee benefits (FEB) ($14.4M). Increased costs associated with operating expenses (OPEX) and investment (CAPEX).

- Increased returns ($7.8M) resulting from rate base growth coupled with an increased weighted average cost of capital.

What is a deferred expense account (DEA)?

A DEA is a regulatory tool used to calculate incurred fees that will be deferred to a later date.

Depending on the situation, deferred fees may be remitted or recovered from customers. If there are fees to be recovered, there will be a rate increase. If there are fees to be remitted, there will be a rate decrease. There are a number of reasons for using DEAs. The most common is the determination of actual results at the end of the year that prove to be higher or lower than anticipated in the rate case. The resulting difference is then incorporated into a subsequent year’s rates.

The rate decrease for transportation ($151M) is largely attributable to two factors:

- First, the reduction in depreciation from the shortfall in the 2022–2023 fiscal year is less than the shortfall in the 2019–2020 fiscal year. This represents a $9.35M decrease in deferred expense account (DEA) depreciation.

- Second, transportation costs were reduced, mainly due to the depreciation of the CFR - Écart de facturation transport zone Nord (DEA - Billing discrepancies for transportation in the Northern Zone), lower fuel costs, and the annualized effect of TCPL’s rate reduction on January 1, 2024. This resulted in a decrease of $9.8M.

- Those decreases are partially offset by lower transportation revenues of $4.3M, also correlated with lower distributed volumes.

The $17.9M increase in the load-balancing rate is mainly due to:

- The increase in the amortization resulting from the shortfalls ($25.3M). In the 2022–2023 fiscal year, a shortfall of $75.8M was identified and will be recovered in subsequent rate cases.

- Increased returns and taxes ($6.4M) resulting from the rate base growth coupled with an increased weighted average cost of capital.

Partially offset by:

- Lower load balancing costs ($11.5M), mainly due to the positive effect of trading transactions leading to optimization revenues, combined with the decrease in TCPL's rates on January 1, 2024, which was not reflected in the 2023–2024 rate case.

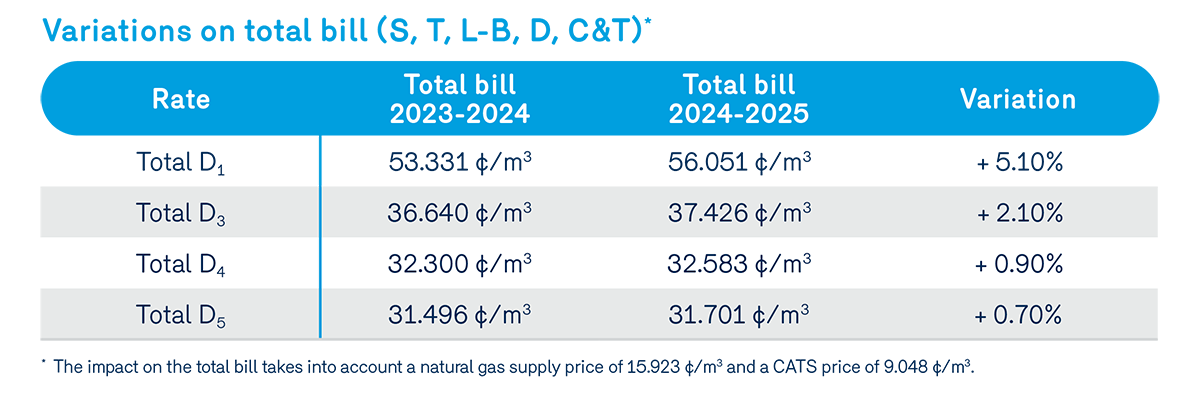

Overall, the proposed increase for transportation, load-balancing and distribution services totalled 6.6%. The variations by service are shown in the table to the right.

The table shows the average variation on a bill attributable to the three services above, for each distribution rate.

For variations in transportation (T), load-balancing (L), CATS inventory-adjustment (I) and distribution (D) services for each rate level, refer to the comprehensive table here.

Following two warmer-than-average winters in 2022–2023 and 2023–2024, the proposed rate increases exceed the five-year average in 2023–2024. However, a second consecutive reduction in transport rates will ease the overall increases.

As indicated in its 2023 Annual Report, Énergir met the target of 1% RNG on its network as required by the Regulation respecting the quantity of gas from renewable sources to be delivered by a distributor. In concrete terms, this represented 60 Mm3, broken down as follows:

- 41 Mm³ of voluntary purchases by customers

- 18.75 Mm³ of socialized volumes

The costs associated with the socialized volumes will be recovered as of October 1, 2024, on all the volumes consumed by customers over a period of one year.

What is the RNG socialization fee?

The RNG socialization fee is 0.135 ¢/m³ for the 2024–2025 rate case. The RNG socialization fee should represent less than 0.5% of the customer’s total invoice.

Customers exempt from the RNG socialization fee

Customers whose consumption of RNG exceeds the objective of the government regulation are not subject to the RNG socialization fee.

Price of Renewable Natural Gas (RNG)

In its 2024–2025 rate case, Énergir filed the proposed price for RNG and is currently awaiting approval to implement it as of October 1, 2024. The price of RNG will increase from $19.12/GJ (72.457 ¢/m³) to $22.65/GJ (85.818 ¢/m³).

The price of RNG represents the average acquisition cost of projected purchases throughout next year. The increase in the average purchase price is due to increasing RNG prices and the fact that Énergir must buy more RNG to meet regulatory targets. Initiatives are underway to stabilize and/or reduce the price of RNG.

Other Changes to the Conditions of Service and Tariff (CST)

In its 2024–2025 rate case, Énergir also requested the following changes in the CST:

Access to interruptible service (D5):

- Entry restriction: A customer wishing to sign up for the interruptible rate must demonstrate its actual ability to interrupt its natural gas consumption.

- Extension of contract: No extension of contract for customers deemed unable to interrupt their natural gas consumption and transfer to stable service at the end of the contract.

Interruptions:

Énergir requests the removal of the requirement to interrupt interruptible service customers for at least one day per winter. Énergir asked the Régie for a decision on this issue by August 30, 2024.

Minimum annual obligation (MAO) for transportation: