Natural gas market conditions

The year 2025 has begun with a roar. On the one hand, due to market concern over the economic impact of the imposition of tariff barriers, the Canadian dollar is taking a battering on the markets, with the exchange rate with the U.S. currency on February 4, 2025 hovering around US$1.44/C$, up 7% compared to January 2024.

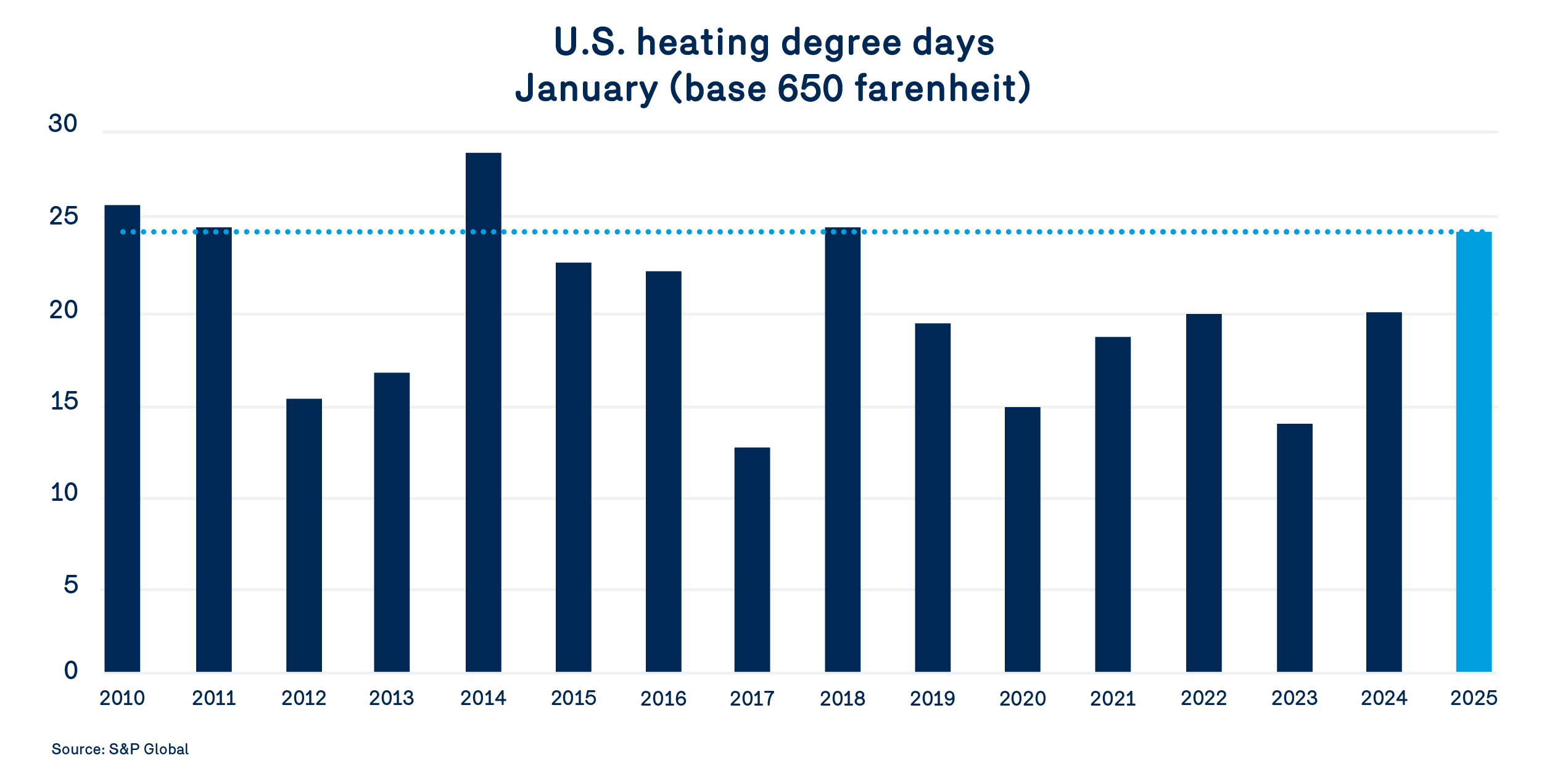

Then there are the January temperatures. According to S&P Global data, heating degree days averaged just over 24 across the United States. This is higher than last year, and you’d have to go back to 2018 or 2014 to find such a cold January.

This has led to strong demand for natural gas, particularly in the residential and commercial sectors. For the month of January, consumption by these sectors was up 9.3% from January 2024. As a result, U.S. domestic natural gas consumption averaged 126.7 Bcf/d, up +7.25 Bcf/d over last year. With a slight increase in demand for liquefaction, total demand increased by +7.91 Bcf/d. At the same time, production—estimated at about 105 Bcf/d in early February—was still lower in January 2025 than in January 2024, about 0.5 Bcf/d lower.

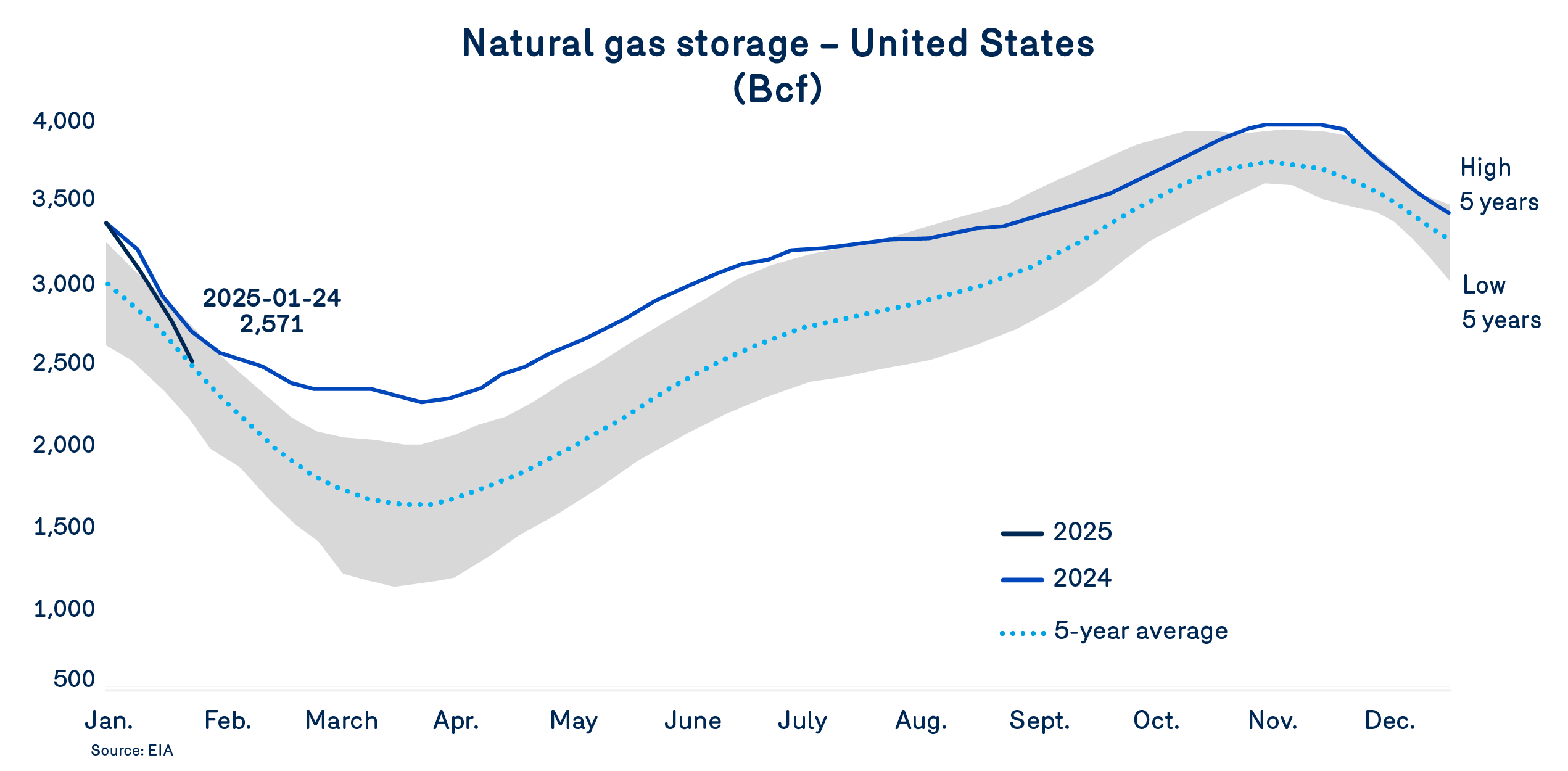

This creates a gas balance conducive to large storage withdrawals. The EIA data does show that storage levels have fallen sharply in recent weeks, to 2,571 Bcf as of January 24, slightly above the average for the five years prior to 2024.

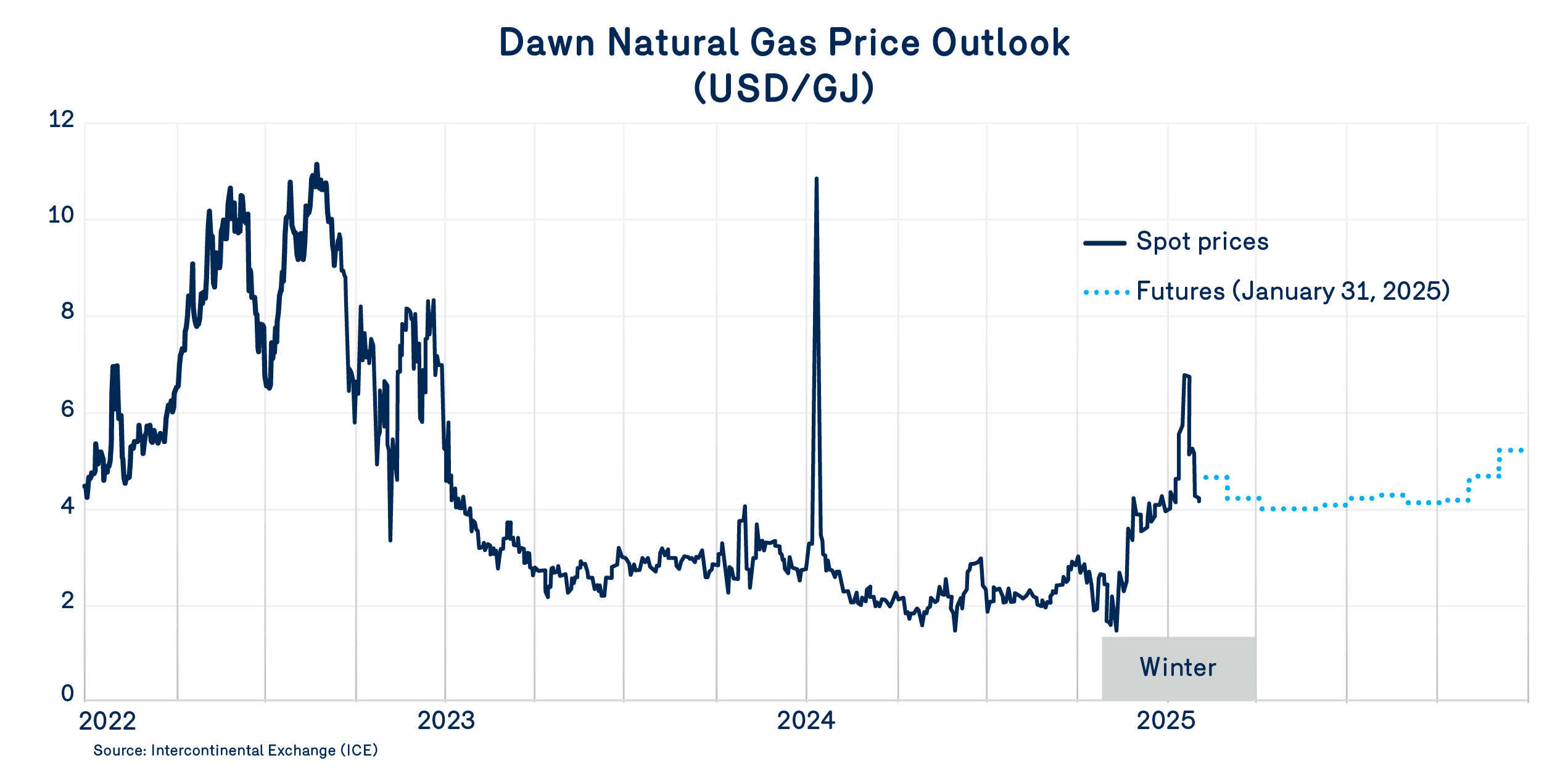

Despite production that appears to be holding steady and even rising further, given the additional demand from U.S. liquefiers and the strength of prices on the main production site hubs, we’ll have to wait for the actual temperatures in February and March before getting a clearer picture of what’s in store for the gas market. While the final assessment can certainly take a little longer to come in, the natural gas price forecast is taking shape a little more each week, with the evolution of futures prices.

Looking at the current environment, the markets are giving us a glimpse of what they anticipate for natural gas prices.

As of January 31, 2025, the average price of natural gas at Dawn for the entire winter of 2024–2025 is expected to hover around $4.08/GJ, or $4.45/GJ excluding November prices.

The most recent futures price data indicates a natural gas price at Dawn of around $5.18/GJ for January 2026, fairly comparable to January 2025 but probably on a very different basis. Three variables in particular should be monitored: February temperatures and their impact on total storage, as well as summer temperature forecasts, which will help gauge how fast storage can be replenished.

The backdrop remains natural gas production. With more encouraging prices for producers, it can be expected to continue to rise to meet additional liquefaction needs. The fragility of this gas balance today lies more on the demand side than on the supply side.