Natural gas market conditions

In North America, the gas market started winter 2024–2025 with record natural gas storage and some of the lowest average prices in the past 20 years.

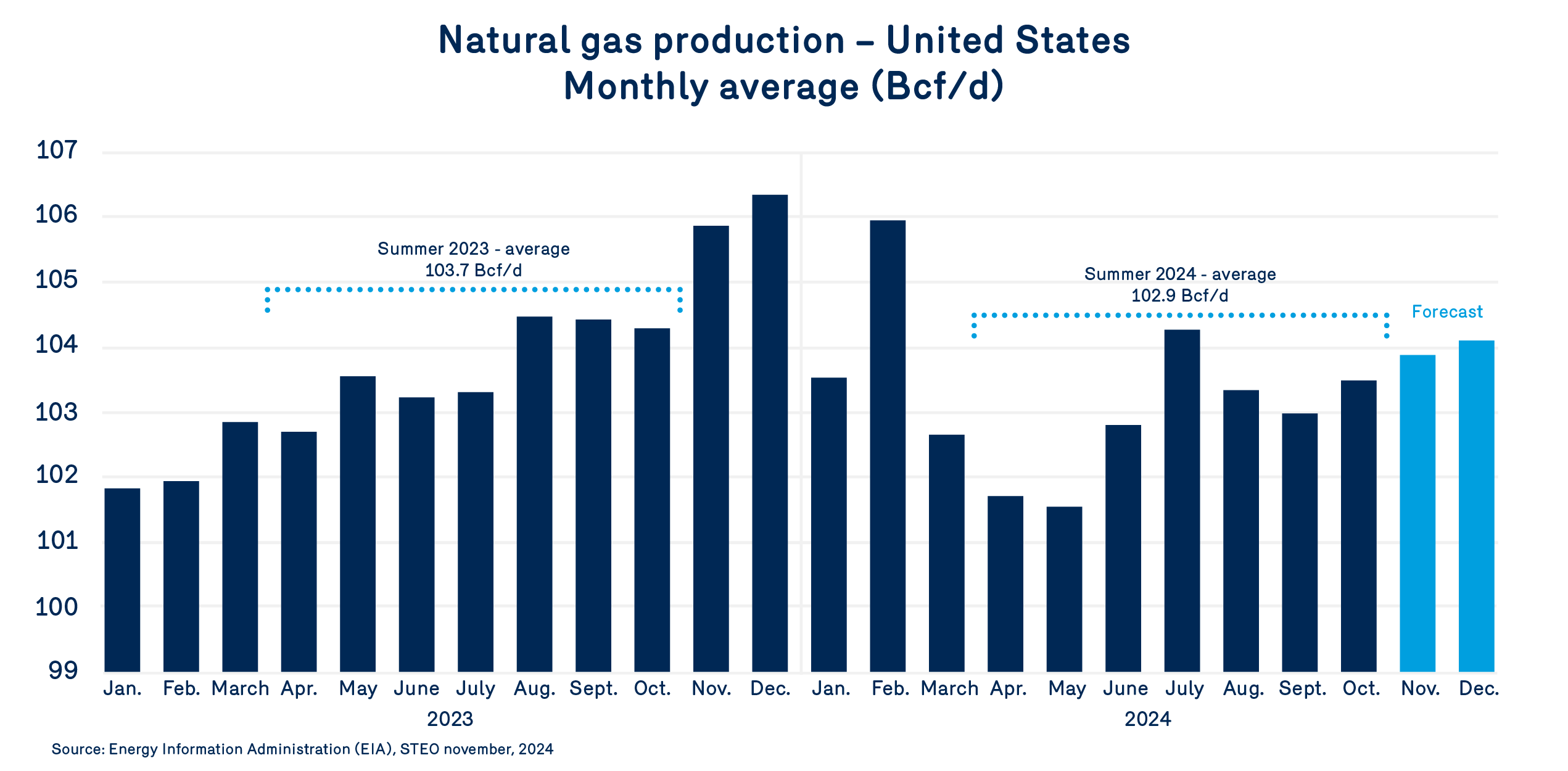

Despite downward adjustments in the first half of 2024, natural gas production in the U.S. was more resilient than expected. Given the low prices offered in the various production basins, we could have expected larger decreases. While producers have lowered their targets and reduced drilling activity, increased productivity and the use of DUC (drilled but uncompleted) wells have maintained a certain level of production.

During the summer of 2024, the decline in production was therefore less than expected last June. We saw an actual decrease of 0.8 Bcf/d for this period compared to average production in summer 2023.

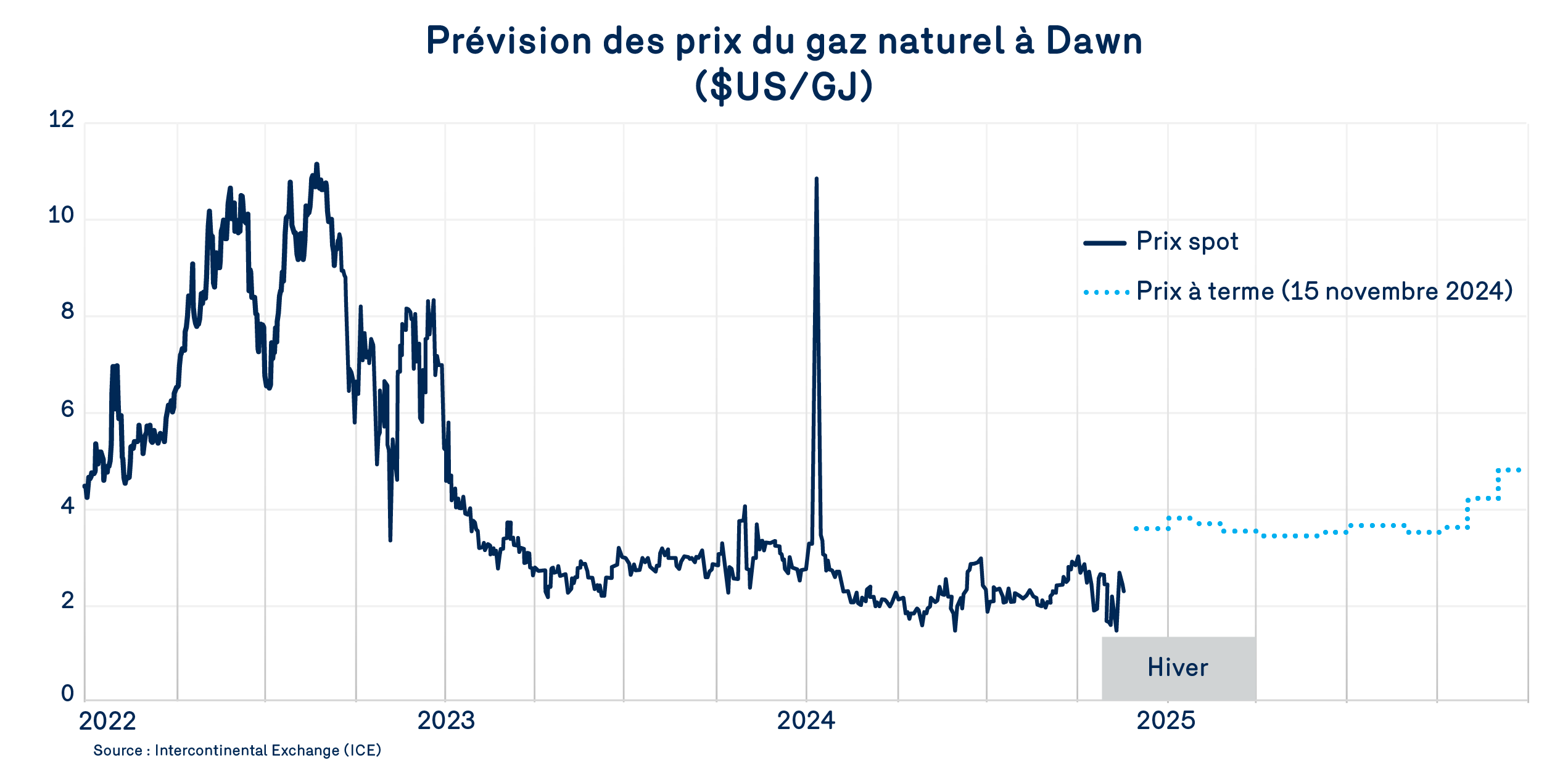

There is, however, a certain nervousness in the markets. The resurgence of a La Niña winter with a higher likelihood of polar cold on the continent and its effects on growth in residential and commercial consumption and in liquefaction demand are factors that could cause real natural gas prices to rise. The difference between actual prices for the first 15 days of November and the price forecast for December 2024 reflects this nervousness.

Markets are also focused on U.S. gas production. While most forecasters have raised their forecast for total U.S. production through the end of March 2025, many have lowered their estimate for the remainder of 2025. Markets are anticipating gas producers to react to low natural gas prices. After increases in productivity and the commissioning of DUC wells, which are now at their lowest number, a change in the pace of production seems inevitable.

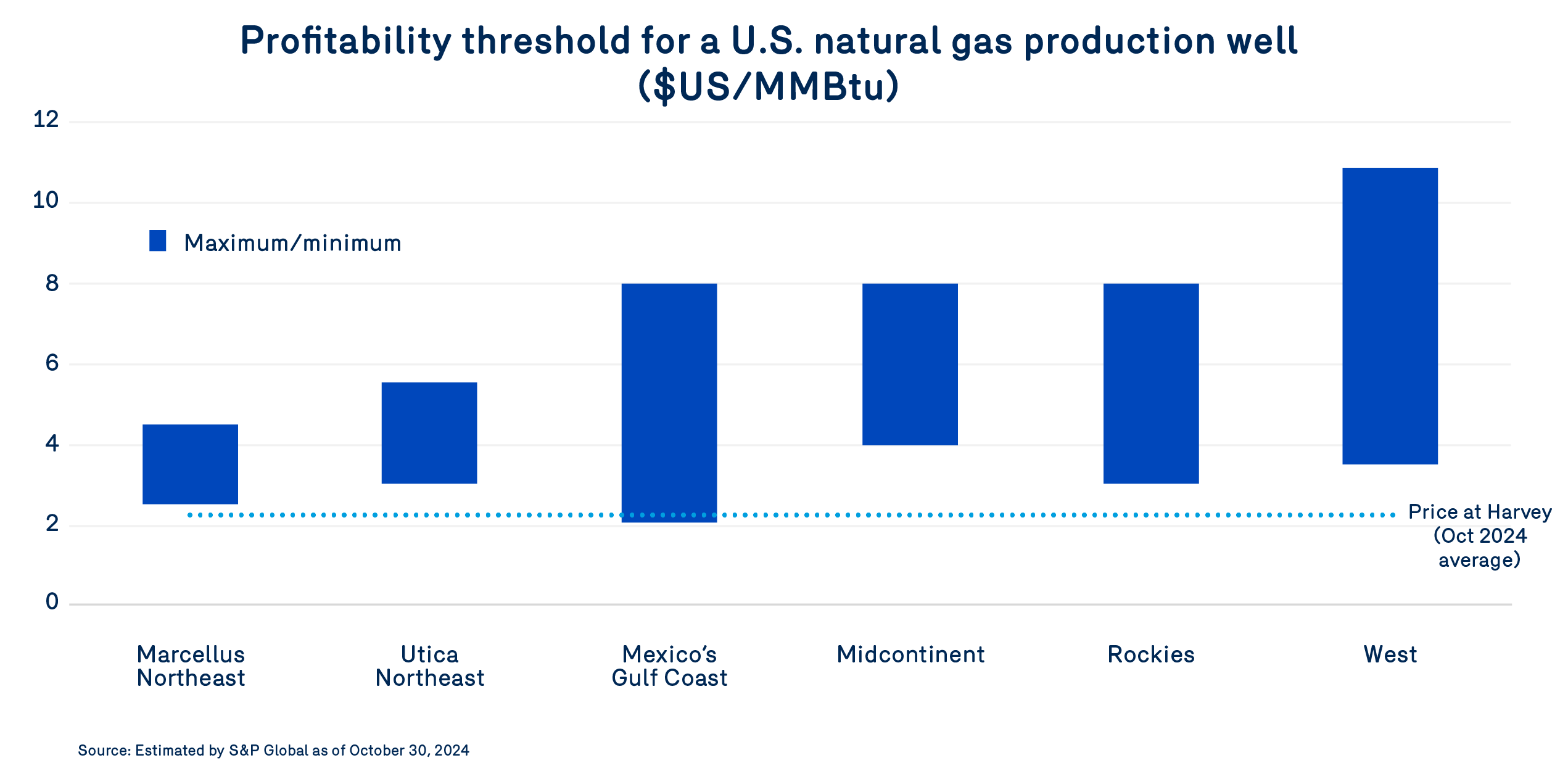

Over the past several quarters, natural gas prices offered to producers have weighed on the profitability of their operations. According to S&P Global, the majority of the estimated break-even points for natural gas wells (including revenues from the sale of related by-products) are above market prices.

Given that situation, a rise in the level of futures prices as a result of slower growth in natural gas production could bring prices back to more sustainable levels for producers.

For the entire 2024–2025 winter, natural gas prices at Dawn are estimated to average close to $3.37/GJ, down $0.97/GJ from the outlook in the last bulletin.

For December 2025, markets are currently forecasting a natural gas price of around $4.75/GJ at Dawn. That said, next winter is still a long way off. One thing is certain: while the natural gas market can be volatile and remains heavily influenced by climatic hazards, the high level of storage is a very real variable that puts downward pressure on prices.