Perspectives on the price of natural gas

Among our memories of summer 2021, we will certainly remember the ups and downs of changes in temperature, as well as the rise in natural gas prices on the North American continent.

Increasing demand of natural gas

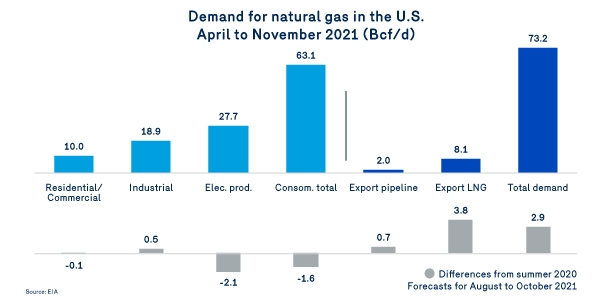

In some regions, the record increase in temperatures and in degree-days of air-conditioning, particularly in June, contributed to supporting natural gas consumption, while temperatures in the following months proved, on average, to be closer to normal. Overall, actual temperatures to date and those expected by the end of summer 2021 should translate into a decrease of about 2.4% in total natural gas consumption in the U.S.

With the recovery of natural gas prices, consumption of natural gas in electricity generation should decrease by 7% from summer 2020. However, this decline in consumption will be more than made up by the increase in net exports of liquefied natural gas (LNG) and exports by pipeline, especially to Mexico.

Along with the global economic recovery, and with temperatures and droughts in other parts of the world, Asian and European demand for natural gas has led to a significant increase in international prices compared with the U.S. Gulf of Mexico price, making it even more competitive. In total, the demand for natural gas, including exports, should increase by 2.9 Bcf/d compared with the average in summer 2020.

Slight increase in supply

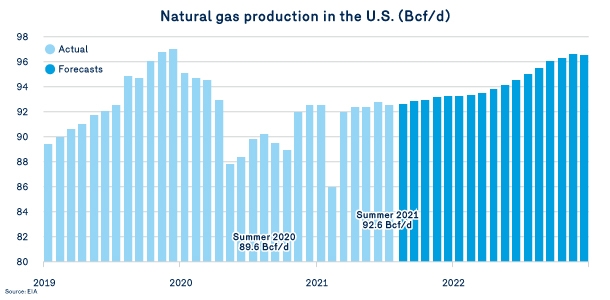

In summer 2021, U.S. natural gas production nevertheless registered a rise equally as high as demand. Compared with the average production of 89.6 Bcf/d recorded in summer 2020, U.S. production rose to 92.6 Bcf/d in summer 2021, an increase of 3.0 Bcf/d. That increase, slightly higher than demand, should translate into maintaining continental natural gas prices.

On the supply side, gas and petroleum producers are expected to remain prudent over the next quarters, keeping their focus on balance sheet consolidation, controlling investment expenses and improving productivity. According to current forecasts, we will not regain the levels of production achieved in December 2019 until the end of 2022.

Sharp increase in the price of natural gas

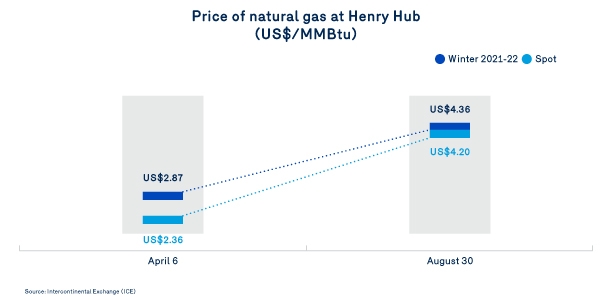

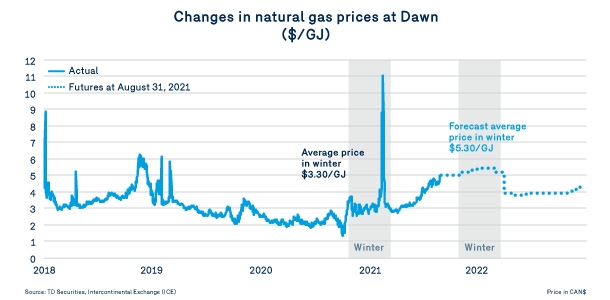

Continental natural gas prices, in part stimulated by strong international demand, also began to rise in early April. On the spot and futures markets for winter 2021-2011, natural gas prices increased by more than 50% between April 6 and August 30 2021.

This was a significant and surprising rebound, given that the supply/demand balance in the U.S. remained stable, which should have maintained continental prices. The change in prices can however be explained by the strength of international demand, driven by the demand for natural gas destined for export to Mexico and by LNG exports.

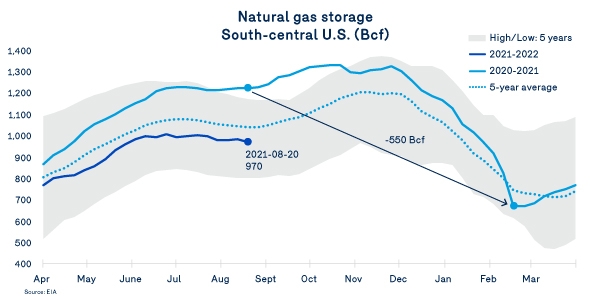

To understand the recent increase in prices, we also need to look at the state of storage in the U.S., particularly in the South. That is where a significant part of American demand is found, including the demand from liquefaction and export terminals. There, as in most regions of the U.S., the level of storage of 970 Bcf is below historic levels, especially those of the past year.

By extrapolating the current storage level of 970 Bcf based on injection and withdrawal data for 2020-2021, we obtain a level of storage that could end up below historic averages by the end of February 2022. We can thus better understand the nervousness of markets regarding the sufficiency of storage to meet demand for gas this coming winter.

Whether this apprehension is founded or not, there is a need to stimulate a rise in current and future prices. As of August 31, 2021, the price of natural gas at Dawn Hub oscillates just above the bar of $5/GJ. For winter 2021-2022, markets are posting an average price around $5.30/GJ, based on the current gas environment.

These forecasts will continue to change based on certain data, including the pace of injection over the next two months, the level of production from the various production basins on the continent, as well as actual temperatures.

Read the other subjects from this bulletin

Énergir: A facilitator for your waste heat recovery projects

Follow-up on regulatory and rate cases

Changes in C&T prices

Change to the Sales Major Industries team