Follow-up on regulatory and rate cases

2020-2021 rate cases

The new rates proposed by Énergir were filed with the Régie de l’énergie on May 7, 2020 and are pending approval. They are scheduled to come into force on December 1, 2020, subject to the decision to be rendered by the Régie de l’énergie. It should be remembered that the sharp rate reductions for all services last year were due to unusual circumstances, and that the return to normal conditions announced last year should now materialize. This return of the pendulum would result in an increase in transportation and distribution rates and a decrease in the load-balancing service.

It is important to note that the rate case was filed with the Régie de l’énergie on the basis of data available prior to the COVID-19 situation. Given the exceptional, ever-changing nature of the socio economic environment in which we currently operate, Énergir’s forecasts and underlying rate adjustments could be revised.

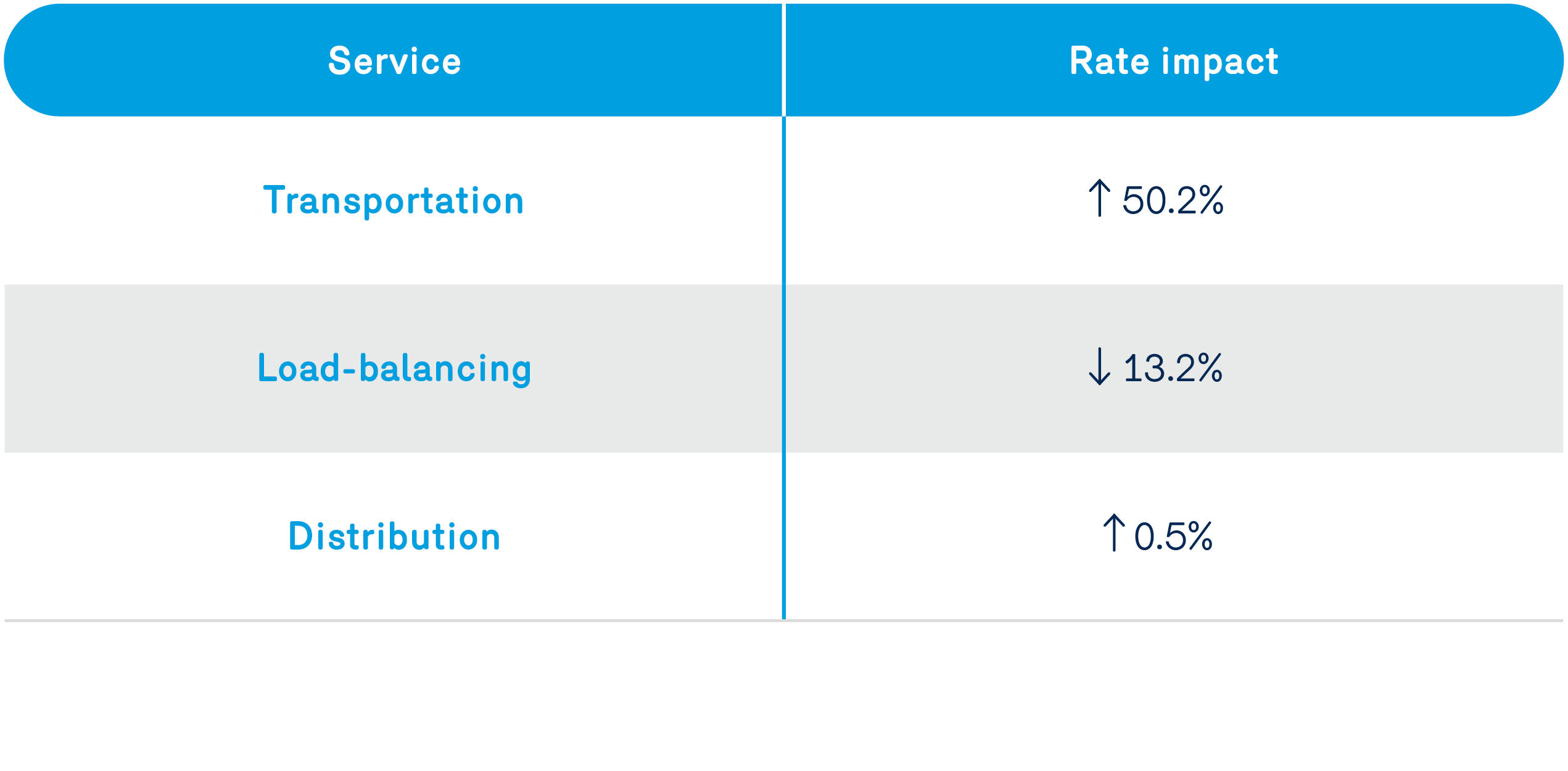

The overall increase in the following three services would be + 4%.

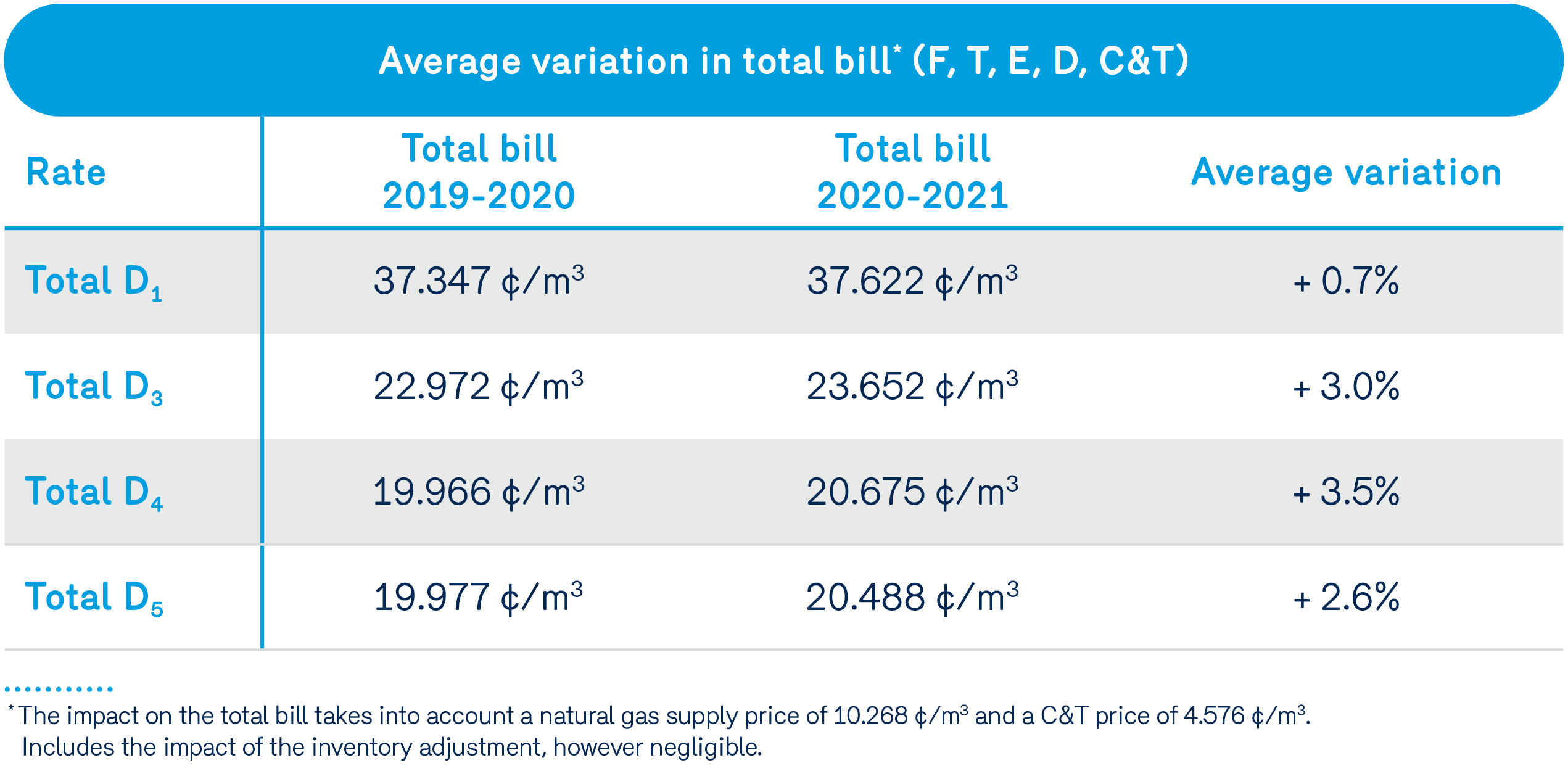

The average variation in the bill caused by these three services, based on the customer’s distribution rate, would be as follows.

However, it should be noted that Énergir anticipates a sharp decline in natural gas supply prices. The average price is dropping from 14.019 ¢/m³ in the 2019–2020 rate case to 10.268 ¢/m³ in the 2020–2021 rate case. Including the impact of this reduction expected in the supply rate, which should offset the increases presented above, the average variation in the total bill would be -8.5% at the D1 rate, -11.7% at the D3 rate, -12.7% at the D4 rate, and -14.0% at the D5 rate.

The main reasons for justifying the rate changes of the various services are:

Transportation:

- Increase in TCE Energy (TCE) carrier rates following the approval of post-2020 rates by the Canada Energy Regulator;

- Difference between supply prices at Dawn and prices at other points of purchase is small compared to the previous rate case, resulting in a smaller transportation credit (note: all purchases are functionalized at Dawn).

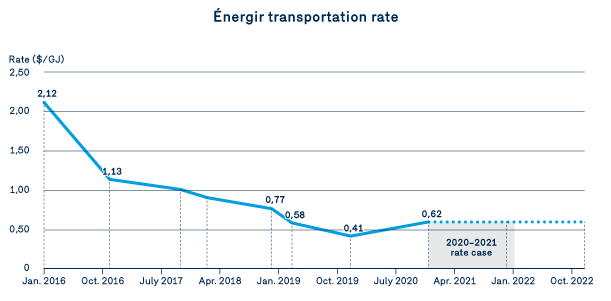

The proposed transportation rate increase takes into account the new TCE rates in the agreement approved by the Canada Energy Regulator, and will take effect on January 1, 2021. Despite this expected increase, the transportation rate would remain at a level similar to that observed at the beginning of 2019, which is significantly lower than in previous years.

Additional rate adjustments, although very small compared to this year, will be reflected in the transportation rate at the time of the next rate case. Lastly, this new agreement stabilizes rates until 2026, barring any unforeseen circumstances.

Load-balancing:

- Lower load-balancing costs due to the acquisition of peak service on the secondary market as an alternative to purchasing short-haul transportation capacity in winter;

- Increase in volumes consumed by small and medium volume (SMV) customers.

Distribution:

Increase in operating expenses offset almost entirely by:

- An overpayment to be remitted to customers; and

- An increase in volumes consumed by small and volume (SMV) customers.

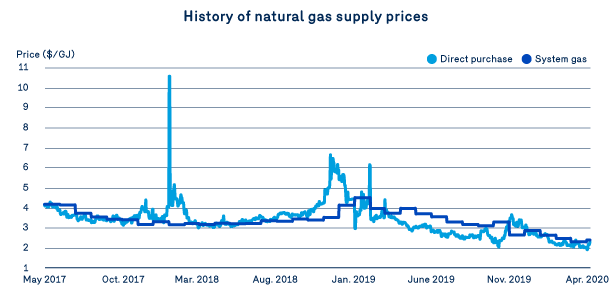

Supply price history:

As shown in the graph below, natural gas supply prices paid during the winter and in early spring are falling. What’s the reason for this unusual trend? The mild winter we experienced and, more recently, the slowdown in business activities during the government-imposed lockdown due to the pandemic. Note that prices were down even before the winter period. Two factors contributed to the decline in supply and demand prices: the high inventories held by buyers who reduced demand and continued strong production by sellers who increased supply.

When interpreting the graph, it should be noted that:

- The light blue “direct purchase” curve represents prices for spot purchases at Dawn, while other customers make their supply purchases on a monthly rather than daily basis. In addition, certain incidental costs such as brokerage fees are excluded. This is therefore an estimate of the prices paid by direct-purchase customers.

- The dark blue “system gas” curve represents the prices charged by Énergir for its supply service. The calculation method takes into account projected prices for the next 12 months when setting the price. This is why the system gas decline is more gradual and less reactive than the direct purchase curve.

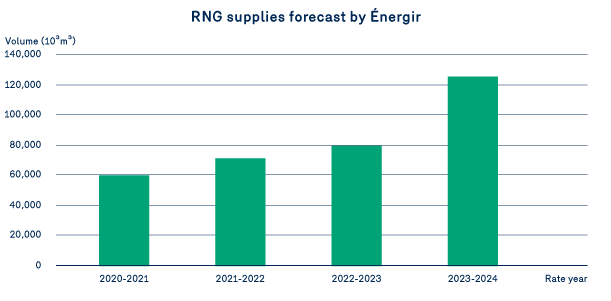

Overview of renewable natural gas (RNG)

As discussed in last February’s Blue Bulletin, Énergir must deliver minimum quantities of RNG in order to meet government regulations. To this end, many RNG-related activities are still ongoing and will continue so as to promote the development of this growing sector in Québec.

It is expected that the number of Québec producers who inject into the Énergir distribution network will increase from one to four during the 2020–2021 rate year:

- Municipal biomethanization site in Saint-Hyacinthe

- Agricultural biomethanization site in Warwick

- Municipal biomethanization site in Saint-Étienne-des-Grès

- And many more announcements to come

From a regulatory point of view, several steps in the file are under way with respect to the purchase and sale of RNG. Énergir is waiting for a decision on RNG purchase contracts and the legal concepts on the interpretation of said regulation. After completing this step, a variety of work will be carried out in conjunction with the Régie, including the pricing strategy leading to the lifting of the “provisional” tariff. We will keep you informed of the long-awaited developments in this area.

Rate reform

In November 2019, an expert report by an independent firm was filed in the rate reform case file, relaunching the rate reform that had been pending since August 2018. Good news! The expert agrees with the key principles proposed by Énergir.

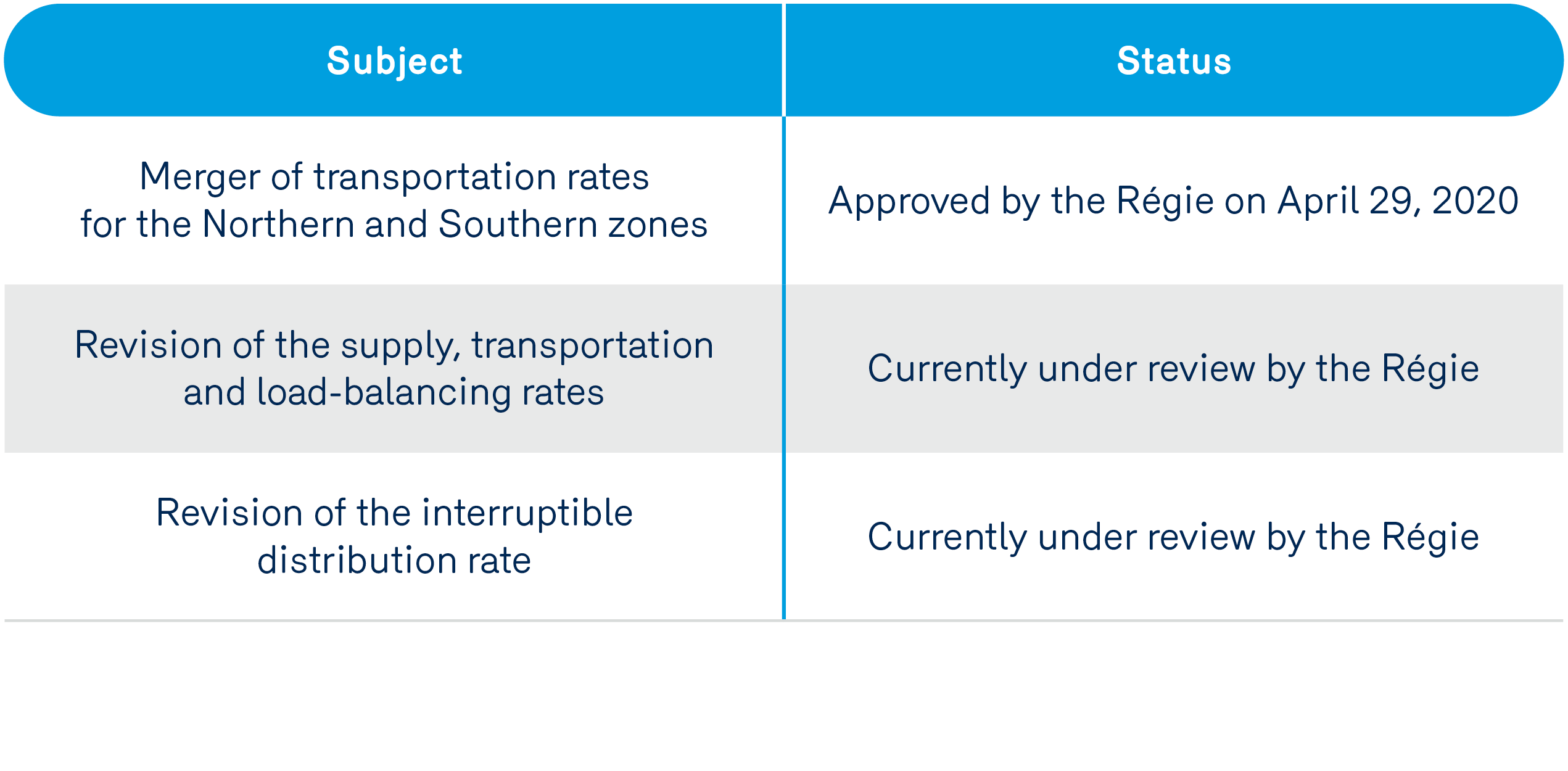

In the table below, you can find the main points of the reform and a progress update.