Natural gas market context and outlook

Some winters are worse than others. This is certainly the case in the current context of the evolution of natural gas prices, including the dramatic economic changes resulting from efforts to combat the COVID-19 pandemic. In North America, the balance between strong natural gas production growth in the United States and a solid, albeit decreased by milder temperatures during winter 2019-2020, demand for natural gas has seen natural gas prices fall to some of their lowest levels since 2016.

Natural gas production

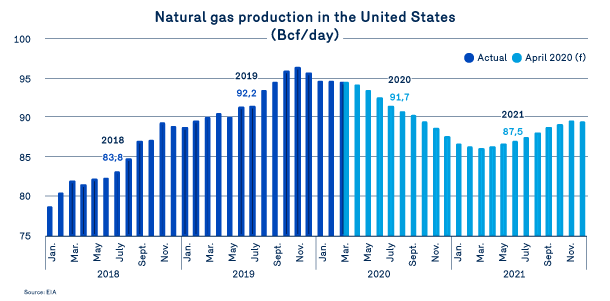

During the winter months of 2019–2020, natural gas production increased by an average of 6.6% compared to winter 2018–2019. During the same period, demand for natural gas saw weaker increases in November and December, followed by decreases in January.

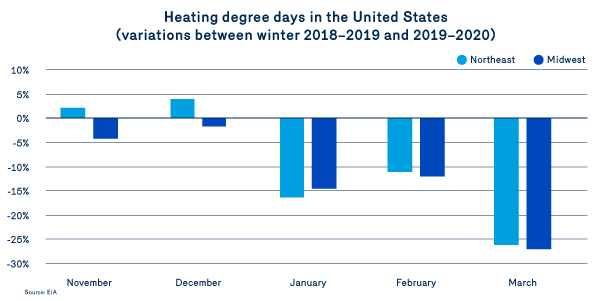

Heating degree days

These decreases in natural gas demand are the result of a significant reduction in heating requirements in the northern regions. For example, in March, heating degree days were 25% lower than at the same time in 2019.

These low temperatures and their downward effects on natural gas demand translated into some of the lowest natural gas prices in recent years.

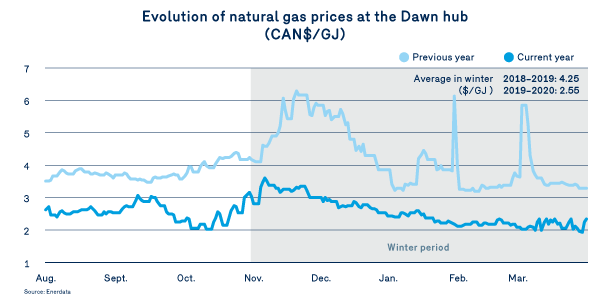

In winter 2018–2019, the average price of natural gas at Dawn was around $4.25/GJ, as opposed to a mere $2.55/GJ in winter 2019–2020. On the one hand, this 40% drop benefits natural gas consumers, encouraging the replacement of higher emission-producing energies with natural gas. On the other hand, these lower prices cause considerable disruption among natural gas producers, who have high production costs, or who are already weakened by the fragility of their balance sheet.

This balance between supply and demand also translated into relatively high natural gas storage levels at the end of March. For the United States as a whole, natural gas storage levels were around 1,986 Bcf at the end of winter 2019–2020, up 79% from the same period in 2018–2019.

A period of upheaval

To date, sustained growth in production and improved transportation capacity between production basins and consumption locations have helped keep natural gas prices below historical averages. However, despite a number of favourable factors, the current natural gas market is also facing several challenges that can affect the natural gas supply and demand balance and the resulting prices.

Natural gas production in North America

On the supply side, there are two factors that could disrupt levels of natural gas production in North America.

- For several months now, the decline in profitability of exploration and production activities, induced by low natural gas prices, has increased pressure on producers to improve their balance sheets. In this respect, a majority of producers operating in the major operating basins have recently announced downward revisions to their capital expenditures for 2020, but indicate that they want to maintain current levels of natural gas production. Already, there is a slowdown in drilling activities in the oil sector in particular, but also in the natural gas sector. From this perspective, the industry is seeking to increase productivity, notably by commissioning wells that have been drilled but not completed, and by relying on financial hedging operations to increase the profitability of production volumes.

- Meanwhile, the drop in global oil prices and the expected reduction in oil production levels in the United States are expected to lead to a reduction in natural gas production associated with oil production. The latest data released by the Energy Information Administration (EIA) show that natural gas production associated with oil production accounted

Combining the expected impacts of these two factors, the EIA predicts a gradual decline in production levels through to the second quarter of 2021. On average, natural gas production is expected to reach 91.7 Bcf/d in 2020 and 87.5 Bcf/d in 2021.

Change in natural gas demand

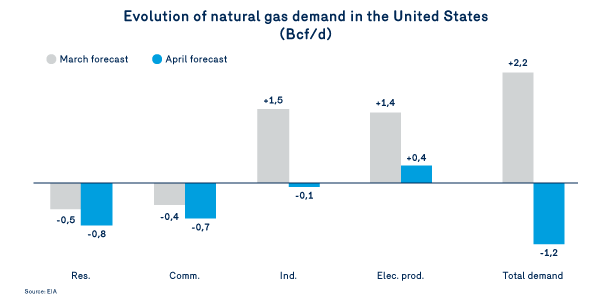

In parallel with these factors that may have a significant effect on natural gas supply, the market will also have to contend with the shock on demand for natural gas due to the economic impact of COVID 19. The anticipated decline in demand is a challenge to monitor given the temperature extremes and the increasing use of natural gas in industries and among electricity producers. However, a comparison of the EIA forecasts in March and April illustrates some of the effects of the pandemic on the natural gas demand forecast.

With all these effects combined, including those tied to COVID-19, the EIA expects total natural gas demand to reach 83.8 Bcf/day in 2020, down 1.2 Bcf/day from 2019. In March 2020, before the magnitude of the pandemic was known, the EIA was forecasting a 2.2 Bcf/d increase in total demand. It should be noted that the EIA is still considering the effects of COVID-19 as it evolves. Therefore, these forecasts could be adjusted.

In addition to COVID-19, the mild temperatures observed in March also contributed to these revised forecasts in demand, in particular with regard to that in the residential sector. However, a significant portion of the revised forecasts in demand for the industrial, commercial and electricity production sectors is due to the effects of the pandemic.

- In the industrial sector, the decline in demand that can be attributed to the decline in economic activity could reach 2 Bcf/day, roughly equivalent to the expected increase in demand for liquefaction terminals in 2020.

- We can also expect to see a reduction in demand for natural gas and electricity in the commercial sector, which is also affected by the lockdown. Similar to the residential sector, a portion of the demand for natural gas in the commercial sector is also affected by temperature fluctuations that directly determine heating and air conditioning requirements. In contrast, demand in the commercial sector has been hard hit by the lockdown and closure of non-essential businesses.

In sum, if the economic disruptions are limited to the second quarter of 2020, it is estimated that the pandemic could lead to a reduction of 2.0 to 2.5 Bcf/d in total natural gas demand in the United States for the whole of 2020.

Lastly, it is important to note that global economic turbulence also affects exchange rates. Between Canada, commodity-exporting countries and the United States—where the currency is perceived as a safe haven—the current pandemic is causing the U.S. dollar to appreciate against a number of currencies, including the Canadian dollar. This, of course, increases the cost of a commodity when its price is converted into Canadian dollars.

Price forecast - a return to some normality

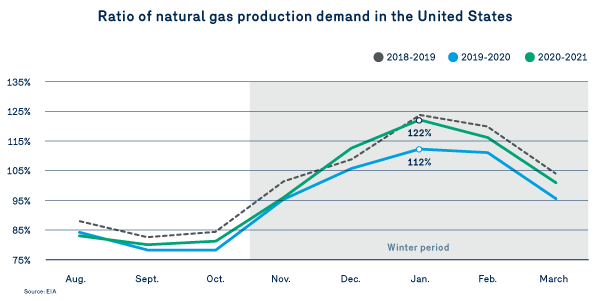

One way to assess the combined effect of these different factors on prices is to observe the evolution of the balance between supply and anticipated demand for natural gas. The following graph shows the ratio of the quantity of natural gas required and the level of production. Thus, a higher ratio indicates the needs to be met through additional net imports, lower net exports or higher storage withdrawals. The most recent forecasts show that the ratio will increase towards the end of the summer through next winter.

Ratio of natural gas production demand

For January 2021, a ratio of 122% is expected compared to 112% in January 2020. January 2020 was characterized by low demand due to milder temperatures and significantly lower prices. It is with this kind of balance in mind that the markets estimate future natural gas prices in the United States and Canada.

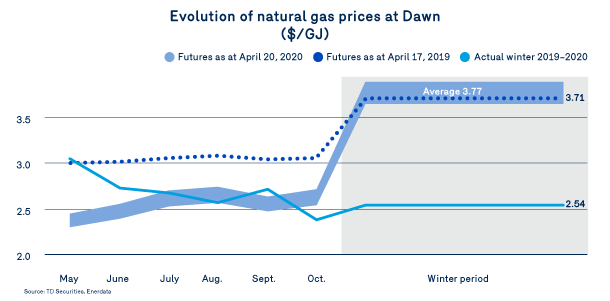

Evolution of natural gas prices at Dawn

On April 20, 2020, the markets tried to integrate the rather extraordinary economic context and combine it with the specific context of the natural gas market. For winter 2020–2021, the markets are forecasting a price of $3.888/GJ with an exchange rate of 1.411 US$/CAN$. Using the April 2019 average exchange rate, we will obtain a price of $3.654/GJ, for an average of $3.770/GJ in winter 2020–2021.

It is interesting to recall that on April 7, 2019, markets were anticipating a price at Dawn of $3.71/GJ for winter 2019–2020. The reality was finally very different with an average price of about $2.54/GJ—which shows that the weather often has the last word.