Natural gas market conditions

In economic conditions impacted by a sharp return to inflation, ongoing labor shortages and supply chains struggling to regain their pre-pandemic efficiency, the North American natural gas market must also deal with special conditions, which are pushing the price of natural gas to historically high levels.

Demand growth outpacing production growth

The growth rate of US natural gas production is affected by a combination of factors. Although producers remain focused on improving their balance sheets, they must deal with rising drilling and production costs as well as transportation constraints between the major North American regions.

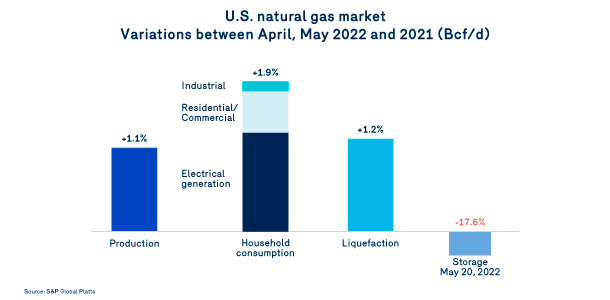

In terms of demand, the cold temperatures in the northern US and relatively warm temperatures in the southern US in April and May 2022 contributed significantly to higher consumption levels in the Residential/Commercial sectors and for power generation. Moreover, demand for natural gas for liquefaction is growing significantly compared to last year and remains near capacity, further stimulating demand.

In short, US natural gas production has been growing since late winter (+1.1 Bcf/d) and is unable to offset the growth in total demand resulting from increased domestic consumption and liquefaction for export.

Concerns about storage forecasts

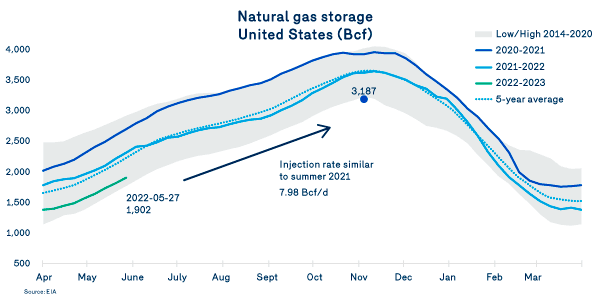

This relatively tight balance pushes spot prices of natural gas to historic highs and reduces storage capacity for natural gas injection in anticipation of winter 2022-23. However, winter 2021-2022 left storage well below historical averages. Currently at about 17.6% under their 2021 level, natural gas storage remains one of the main market concerns.

Storage is essential for meeting winter demand and balancing the market. Injections in storage are on top of domestic consumption and exacerbate market tensions. In the current environment, several analysts expect that it will be difficult to inject at a rate that will bring US storage up to the average level over the past 5 years.

The US natural gas storage forecasts for winter 2022-23 may be a concern. Even by increasing the storage at last year's rate by about 8.23 Bcf/d, the expected level in early November 2022 would be slightly less than 3,200 Bcf and at the minimum for the past 7 years. While this level of storage remains largely sufficient to support production in meeting winter needs, it is still a source of concern on markets.

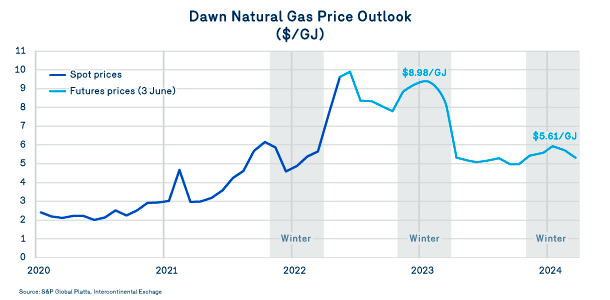

Prices that reflect concerns

Not surprisingly, recent developments in natural gas prices on spot and future markets clearly reflect these concerns as well as those arising from a summer that may be warmer than normal. As of June 3rd, 2022, spot prices at Dawn were around $9.50/GJ and forward prices until April 2023 remained at the same level, representing record prices that many experts have trouble explaining.

Whether justified or not, these prices are currently very real and are directly impacting consumers. However, it is important to keep in mind that there may be many new developments between now and next winter.

The highly volatile prices will respond quickly in the event of cooler summer temperatures or milder winter temperatures than normal. On the other hand, high prices and higher productivity could contribute to increases in drilling and production levels in the US beyond what is currently expected. Producers could yet again surprise us.

Read the other subjects from this bulletin

Renewable natural: now available

Energy efficiency programs and industry 4.0 applied to energy efficiency

Changes in Cap-and-Trade prices