Natural gas market conditions

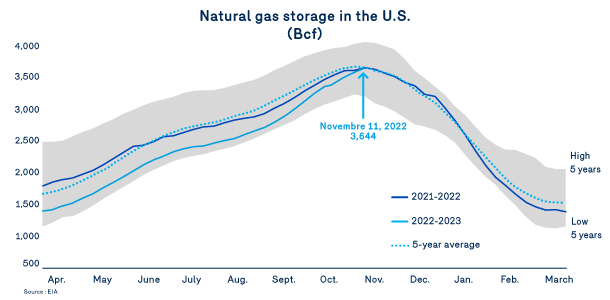

The injection season ended on a positive note with significant increases in U.S. natural gas storage levels. After lagging 22% behind at the end of March 2022, total storage on November 11, 2022, had reached 2021 levels and was approaching the average for the past 5 years, with 3,644 bcf in inventory. This high level of inventory is a scenario that seemed unlikely this past summer, as seasonal heat drove up U.S. natural gas consumption and left little opportunity to replenish stockpiles.

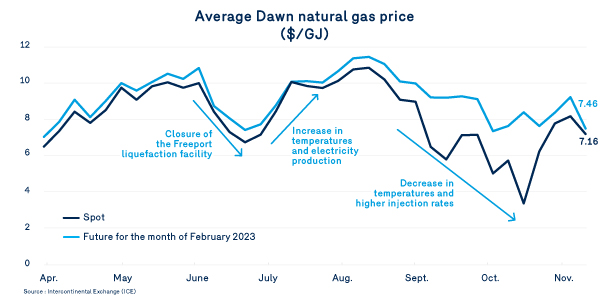

Gas spot prices responded in kind, fluctuating with the temperatures and storage data to hit a high of $11/GJ in mid-August before temporarily falling back below the $4/GJ mark in early November. These highly volatile and sometimes record-breaking prices were the result of a gas balance characterized by resilient domestic consumption, supply that is growing but at a slow pace, and liquefaction demand hampered by limited export capacity.

A balance expected to carry over into winter

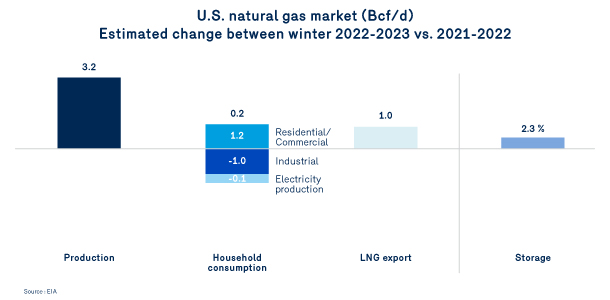

On the supply side, the U.S. Energy Information Agency (“EIA”) forecasts a moderate downturn in natural gas production over the coming months due to colder temperatures and transportation constraints that could limit the movement of natural gas from major production basins to consumption sites. However, U.S. production is projected to be 3.2 bcf higher for the 2022–2023 winter period in comparison to winter 2021.

On the demand side, the likelihood of cold weather has led to an increase in the Residential and Commercial demand forecast. On the other hand, the global economic slowdown could push consumption down in the Industrial sector. Overall, domestic consumption of natural gas is expected to be lower than in the winter of 2021–2022.

However, demand for gas for liquefaction and export is expected to be higher than last year due to capacity additions in 2022. In the current international environment, and with the resumption of operations at the Freeport liquefaction facility in Texas, demand for natural gas is expected to increase by 1.0 Bcf/d in comparison to winter 2021–22 and should easily exceed 12 Bcf/d on average.

To sum up, the supply/demand balance should theoretically lead to prices easing off relative to last summer and to the winter of 2021–2022. In practice, however, prices are easing, but not as much as expected.

Of course, weather is also playing a role. Colder temperatures in mid-November and the temporary production slowdown forecast by the EIA combined to drive up prices, reflecting market nervousness despite market fundamentals and replenished stocks. Forecasts of a La Niña winter for the third year in a row are also fueling market jitters.

As we know, colder November temperatures make for increased consumption that can increase storage withdrawals and accelerate recourse to other procurement tools. Although more seasonal temperatures have since returned, the signal of a more cautious or nervous market is now out there.

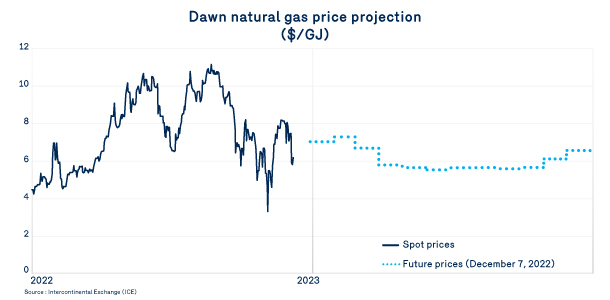

As of December 9, 2022, markets were anticipating Dawn prices averaging $6.96/GJ for winter 2022–2023. As temperatures and overall natural gas production increase at winter’s end, prices are expected to fall to around $5.84/GJ starting in April 2023.

Read the other subjects from this bulletin

Goodbye Sales Major Industries, hello Energy Solutions - Major Industries

Renewable Natural Gas

Energy Efficiency

Carbon Market