Market outlook for natural gas against the backdrop of the conflict in Ukraine

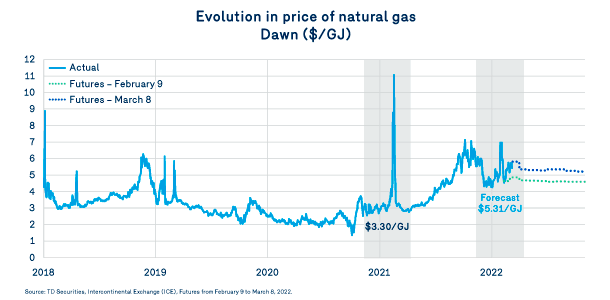

As winter draws to a close, the world’s attention is focused on the conflict between Russia and Ukraine. In a complex geopolitical context, the conflict and retaliations can be felt in energy markets, where three impacts on the North American gas market can be identified:

1. On the one hand, Europe’s energy needs, in particular with respect to liquefied natural gas (LNG), will further stimulate the liquefaction and export of LNG from producing countries such as the United States. However, with an average liquefaction of nearly 14 Bcf/d since early 2022, the U.S. is already operating at full capacity and cannot consider additional exports for a few more quarters. These exports have had an impact on North American prices since the second half of 2021 and will continue to put upward pressure on natural gas prices across the continent, particularly in New England. However, these pressures remain limited given the small proportion of these exports on total continental demand.

2. On the other hand, rising oil prices and the desire to reduce dependence on Russian oil could lead to an acceleration of drilling activity in oil basins, particularly in the southern United States. Stronger oil production would inevitably lead to an increase in associated natural gas production and improve the gas balance as well as reduce the pressure of North American LNG exports on natural gas prices.

3. Lastly, the impact of current oil price increases on North American natural gas competitiveness cannot be discounted. Without necessarily increasing natural gas consumption in the medium and long term, improving the competitiveness of natural gas prices in North America helps maintain current consumption levels and strengthens its position with respect to other forms of energy that are more sensitive to international fluctuations.

For a detailed review of the natural gas market, please see the February 2022 Express Blue Bulletin.

Read the other subjects from this bulletin

Decarbonization process

Case studies in energy efficiency

Changes in Cap-and-Trade prices