Natural gas price outlook

Natural gas demand

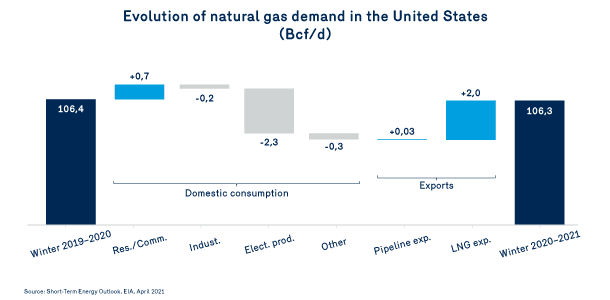

In addition, the global economic recovery boosted US LNG exports, while the return to more normal winter temperatures led to a slight increase in demand for the residential and commercial segments.

Natural gas prices - Winter 2021

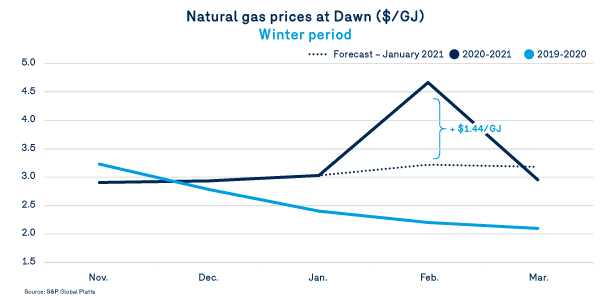

Winter 2020–2021 will be most remembered for the cold snap that swept across central North America in mid-February, creating major challenges for energy production and distribution networks.

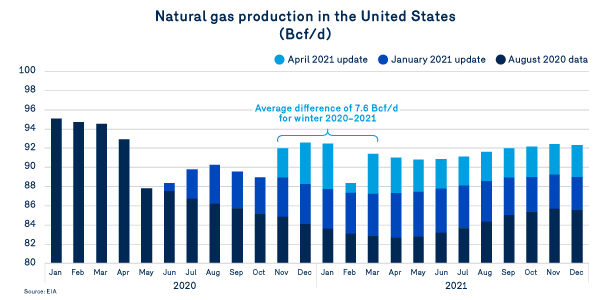

According to the Energy Information Administration (EIA), production levels in winter 2020–2021 will be about 7.6 Bcf/d higher than it predicted last August, an improvement of about 9%. We can therefore conclude that the gas market has been more resilient to cyclical and structural disruptions than initially estimated by the markets and experts.

Of course, financial prudence and balance sheet improvement are still called for when it comes to US gas producers. However, increased actual production levels are testament to efforts to improve productivity on the part of producers amid more favorable gas prices. This was also the case for oil, with the price of WTI at over US$60.

Natural gas production

Fortunately, the effects of the cold front on northeastern markets were short term and were eventually mitigated by a surprising uptick in gas production. By January, estimates for actual production in the United States were slightly higher than forecasts at the very beginning of winter. This trend has continued, as more recent data still indicates higher actual production levels than those forecast.

According to the Energy Information Administration (EIA), production levels in winter 2020–2021 will be about 7.6 Bcf/d higher than it predicted last August, an improvement of about 9%. We can therefore conclude that the gas market has been more resilient to cyclical and structural disruptions than initially estimated by the markets and experts.

Of course, financial prudence and balance sheet improvement are still called for when it comes to US gas producers. However, increased actual production levels are testament to efforts to improve productivity on the part of producers amid more favorable gas prices. This was also the case for oil, with the price of WTI at over US$60.

Price forecasts

In the short term, summer temperatures and air conditioning needs in the United States will shape the initial assumptions used as a basis for continental price forecasts for winter 2021–2022.

In Canada and the United States, natural gas storage levels are above historical averages but still below levels recorded on the same date last year. Given these circumstances, the gas market's mood will be sensitive to supply and demand, as well as storage injections between now November.

In the medium term, the focus will be on fluctuations in gas production and the contribution of natural gas related to oil production. Other factors will also play a role, such as demand for natural gas for liquefaction and exports. Currently at close to full capacity, liquefaction and US exports of natural gas will struggle to grow at the same pace in winter 2020–2021. Temperatures in Asia and European demand will likely have the last word on whether LNG exports stay stable or decline.

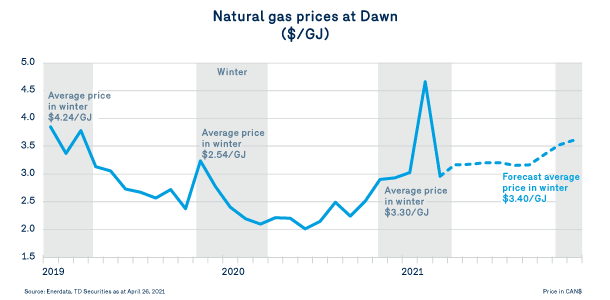

Under these circumstances, the markets currently anticipate a price of $3.35/GJ for natural gas at the Dawn hub for 2021 as a whole and $3.40/GJ for winter 2021–2022.

Although these prices are higher than actual prices recorded for previous periods, they are within historical averages. Changes to supply and demand may influence this price outlook, but ultimately, actual temperatures will dictate the final result.