Natural gas price outlook

We will remember 2020 as a year that profoundly disrupted economic and social dynamics and destabilized a number of markets, including the energy market. Since the start of the year, the North American natural gas market has essentially been affected by three factors.

1. A drop in natural gas prices

First, low natural gas prices due to a significant drop in demand and strong production until the first quarter of 2020 have forced producers to reduce investments and production levels in order to boost their profit margins.

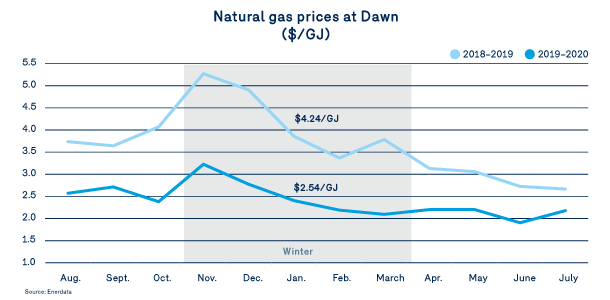

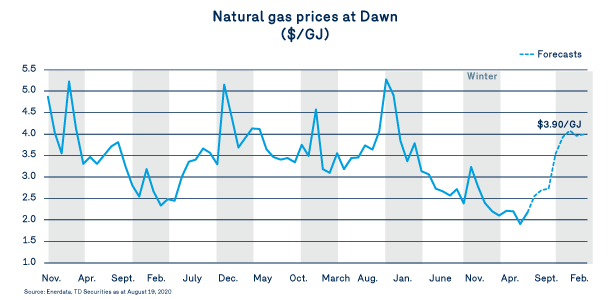

Sitting below $2.50/GJ since the beginning of the year, the monthly average for daily prices at the Dawn Hub in the 2019–2020 winter was 40% lower than the average recorded the previous winter.

2. Effets of the oil shock

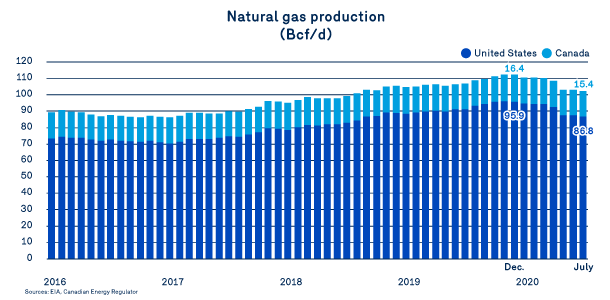

Second, there has been a significant decline in United States natural gas production due to falling petroleum product prices, which has impacted drilling activities and associated oil and natural gas production levels. In the end, natural gas production will have tumbled in Canada and in the United States, with declines of -5.8% and -9.5%, respectively, between the December peak (95.9 Bcf/day in the United States and 16.4 Bcf/day in Canada) and the current levels estimated for July 2020 (86.8 and 15.4 Bcf/day respectively).

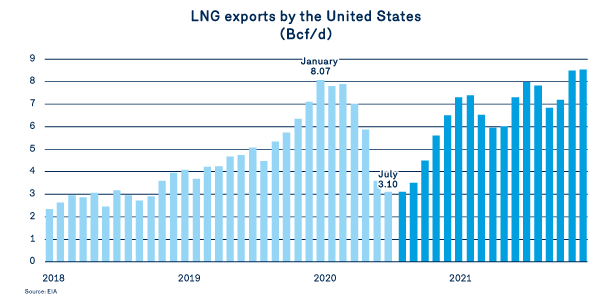

In addition to falling domestic consumption, total U.S. demand for natural gas was hard hit by the global economic slowdown, resulting in a major drop in liquefied natural gas (LNG) exports. The following graph shows the monthly averages of these exports, as well as the latest forecasts from the Energy Information Administration (EIA), which anticipates a strong recovery in this activity by the end of the year.

High storage levels

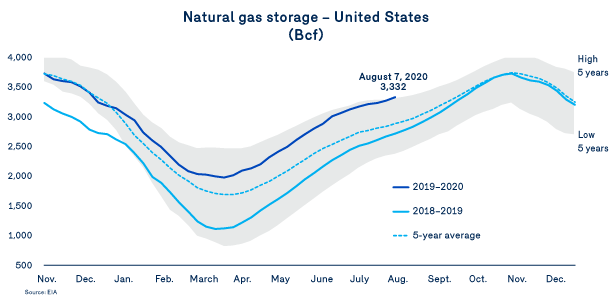

Lastly, another aspect of this delicate balance on which natural gas prices are based is natural gas storage in Canada and the United States, which is currently at its highest levels in recent years. The milder temperatures at the beginning of the year, which reduced storage withdrawals, and the significant slowdown in demand in the second and third quarters of 2020 are among the reasons for this marked increase in storage levels.

Natural gas price forecasts for 2020-2021

Such high storage levels are normally reassuring to markets when interpreting the supply-demand balance and deducing price forward curves. However, despite these storage levels, the current context, which is marked by projected declines in natural gas production and a recovery in demand as of the fourth quarter of 2020, is spurring the markets to upgrade their price forecasts for next winter.

In late August, the markets anticipated the price of natural gas at the Dawn hub to be $3.90/GJ for the 2020–2021 winter. That’s much higher than the actual price recorded during the previous winter but is still within the range of average historical prices. That said, the situation is evolving rapidly as the weeks go by, as production and demand trends become clearer and temperature forecasts are confirmed. However, we should keep in mind that weather is often a determining factor and that the price of natural gas in the winter of 2020–2021 will be largely dependent on it.