Express Blue BulletinNew rates for fall 2021

The new rates proposed by Énergir were filed with the Régie de l’énergie on May 4 and are pending approval, with a target application date of October 1, 2021.

To avoid extending the 2020–2021 rates beyond the end of the rate year, and consequently deferring future rate differences due to a delayed application, Énergir has specifically asked the Régie for the proposed rates to be applied on October 1, 2021. However, the adoption of the rate change may be postponed until late fall, as rate changes are always set and approved by the Régie. We will keep you updated on this topic as decisions are made by the Régie.

While we had a very advantageous pricing environment in the last two years, we anticipate a rate increase for transportation, load-balancing and distribution services for the 2021–2022 rate year. This increase is primarily due to the coinciding increase in the amortization associated with a number of deferred expense accounts (DEAs).

What is a DEA?

A DEA is a regulatory tool used to calculate fees incurred that will be deferred to a later date. Depending on the situation, deferred fees may be remitted to or recovered from customers. If there are fees to be recovered, there will be a rate increase. If there are fees to be remitted, there will be a rate decrease. There are a number of reasons for using DEAs. The most common is the determination of actual results at the end of the year that prove to be higher or lower than anticipated in the rate case. The resulting difference is then incorporated into a subsequent year’s rates.

Transportation service

For the transportation service, the rate increase primarily reflects the shortfall observed at the end of the 2019–2020 fiscal year, the recovery of which is included in the 2021–2022 rate case. This shortfall was due to a difference between:

- Supply prices at the purchase points set out in the 2019–2020 rate case

- Actual supply prices at the purchase points observed during that year (Reminder: All purchases are functionalized at Dawn.)

This situation resulted in the determination of a debit for transportation, rather than a credit as anticipated in the rate case, and a DEA, which will be recovered from customers. It’s important to understand that the scope of the increase for the transportation service was also influenced by the previous 2020–2021 rate, which was very low as it included the remittance of an overpayment from 2018–2019. Given the transition from a rate that includes an overpayment to a rate that includes a shortfall, the increase is even steeper.

It should be noted that a portion of the rate increase for the transportation service stems from a rate increase for TransCanada PipeLines Limited (TCPL) as of January 1, 2021, the impact of which will extend over all 12 months of 2021–2022, whereas its impact lasted only nine months in 2020–2021. It’s important to remember that rate for Énergir’s transportation service benefited from significant reductions in fiscal 2018–2019 and 2019–2020 due to the remittance of overpayments via TCPL rates.

Load-balancing service

For the load-balancing service, the increase was primarily due to a six-month lag in applying the rates for carrier TCPL. As TCPL’s rates went up on January 1, 2021, a portion of the costs associated with this increase have been deferred. More specifically, TCPL’s rate increase for the period of April to September 2021 is only reflected in the rates set out in the 2021–2022 rate case, which we hope will take effect on October 1, 2021.

Distribution service

For the distribution service, there are several DEAs responsible for the increased amortization, including:

- Temperature stabilization account: strong downward pressure on rates last year due to the remittance of price differences related to colder-than-usual temperatures in the winter of 2018–2019 versus amounts recovered in 2021-2022 rates due to warmer temperatures in 2020 and 2021, which led to an increase.

- Reduction of the overpayment in 2019–2020 versus 2018–2019, resulting in an increase.

- As the economic environment has resulted in falling interest rates, we have recognized budgetary variances in 2019-2020 in the calculation of future employee benefits, resulting in higher amortization expense related to employee future benefits.

- Delayed application of 2020–2021 rates, i.e. on December 1, 2020 instead of October 1, 2020.

Strategy for mitigating the increase

It’s important to note that such a situation, i.e. a rate case in which the amortization of nearly all DEAs is subject to an increase, is unforeseeable. It depends on a number of factors that are independent of one another.

Énergir understands that this is a rate major increase for its customers, which is why we have proposed the following solutions to the Régie to mitigate it:

- Amortize balances to be recovered from customers over a longer period of time

- Remit the balance tied to 2018–2019 taxes to customers sooner

This mitigation strategy, which entails spreading out the increased amortization, would reduce the rate impact of transportation, load-balancing and distribution services by 5.7% for the 2021–2022 rate year compared to what it would be with a standard amortization period.

Details of variations

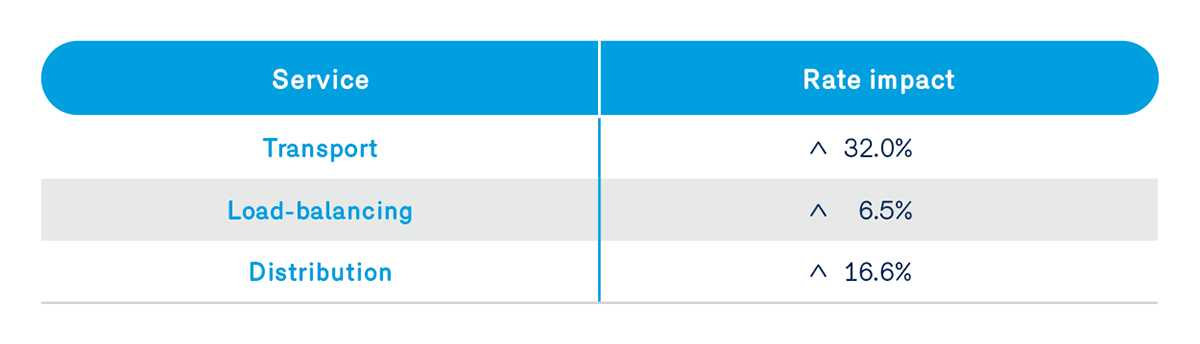

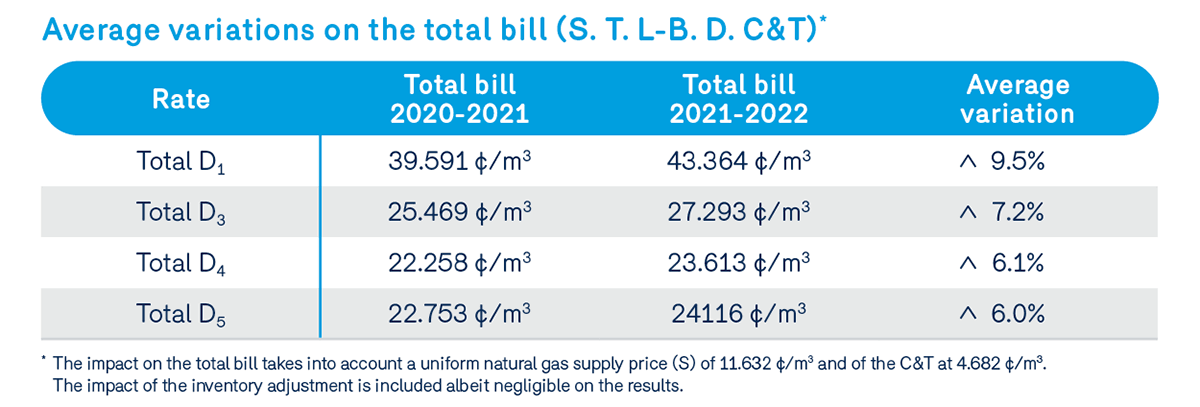

The overall increase for transportation, load-balancing and distribution services is 17.6%. This percentage incorporates the elements of the mitigation strategy mentioned above. The variations by service are presented in the following table:

The table below presents the average variation in the bill for the three above services for each distribution rate:

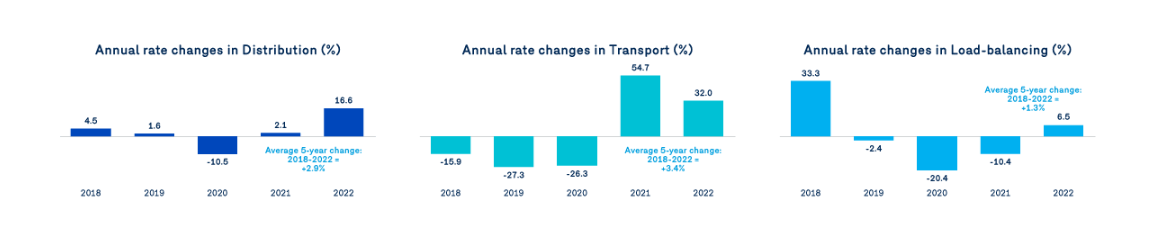

Annual rate variations per service

It is important to remember that following downward variations in previous years, rates for the various services remain at historically low levels in 2020 and 2021 (with the exception of SPEDE). Therefore, despite the significant annual bill increase expected in 2022, the overall cost is actually at a level comparable to 2019, with the exception of distribution.