Blue Bulletin

Majors Industries

December 2025

Natural Gas Market Conditions

The 2025-2026 winter is on its way, and all indications point to more volatility for natural gas prices as compared to last winter.

The market in Canada

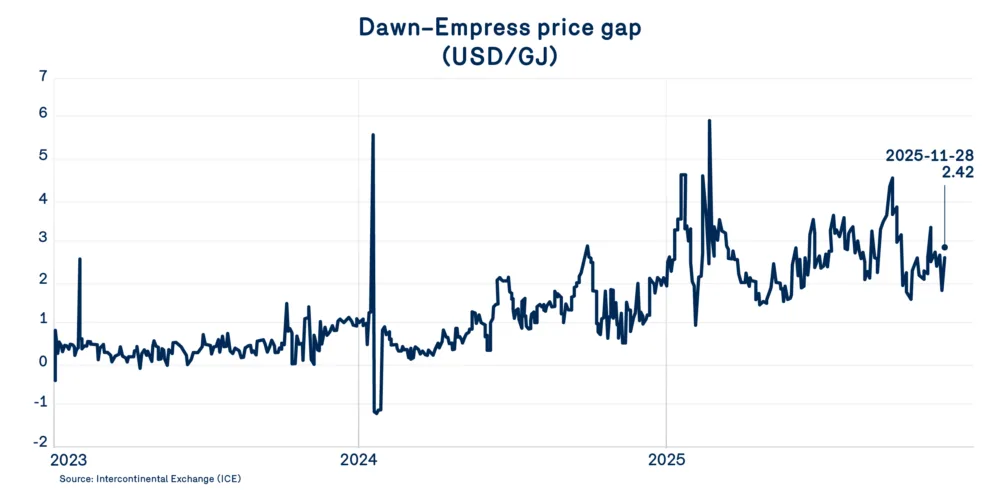

In Canada, the natural gas market displays two distinct regional profiles. In Western Canada, natural gas storage remains at record levels, while production shows little inclination to drop in order to restore some balance despite the growing price gap between western Canadian hubs and other major hubs across the continent. Significant storage and strong production are increasing available volumes, resulting in congestion at the eastern Alberta border (Empress and McNeil) and contributing to lower Western Canadian prices through wider spreads with continental hubs such as at Dawn. An average gap ranging from $2/GJ to $4/GJ is likely to continue as long as production and storage remain high.

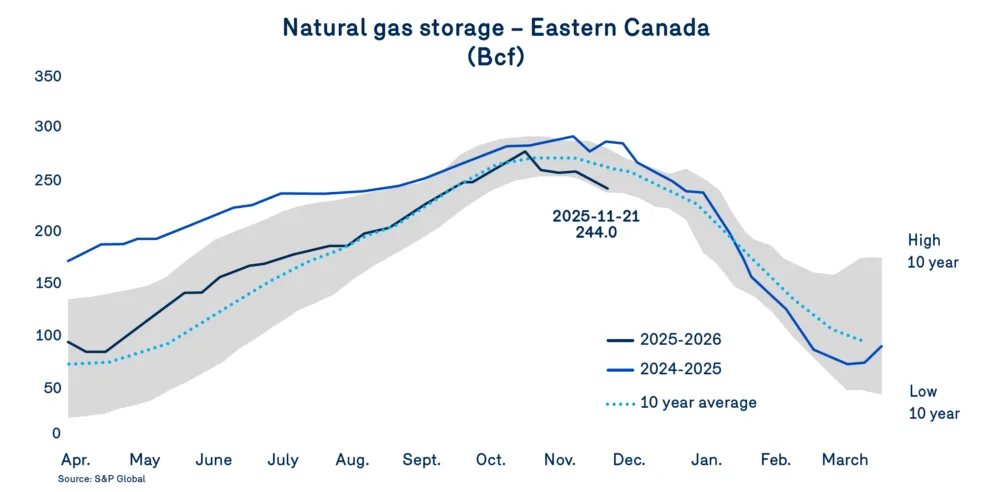

In Eastern Canada, the situation is quite different. Storage levels are modest and currently tracking near historical minimums. Colder-than-normal temperatures in the Northeast since early October brought the injection season to an early close and initiated withdrawals from storage. Estimated storage levels as of November 21, 2025, are near 10-year lows. The same is true for storage in the broader Northeastern United States.

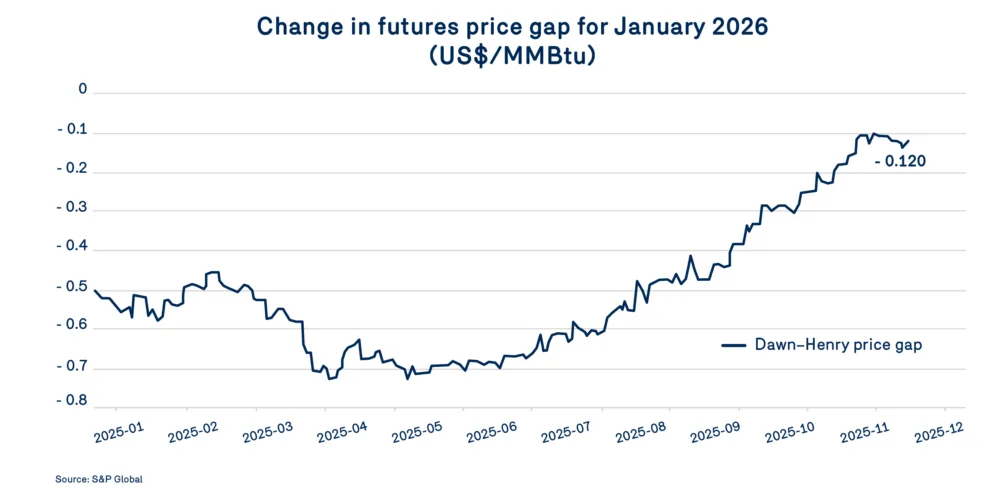

This does not pose any significant challenge to the price equilibrium at the Dawn Hub, although it may generate some price volatility and narrow the favourable spreads with Henry Hub. Obviously, the tightening of the differential between Dawn price and the Henry Hub benchmark is not driven solely by storage conditions. It also reflects short-term expectations regarding regional market balances –such as temperature forecasts, production trends, LNG exports, and transportation capacity constraints. Overall, this narrowing gap points to a relatively tighter regional gas market.

U.S. Market

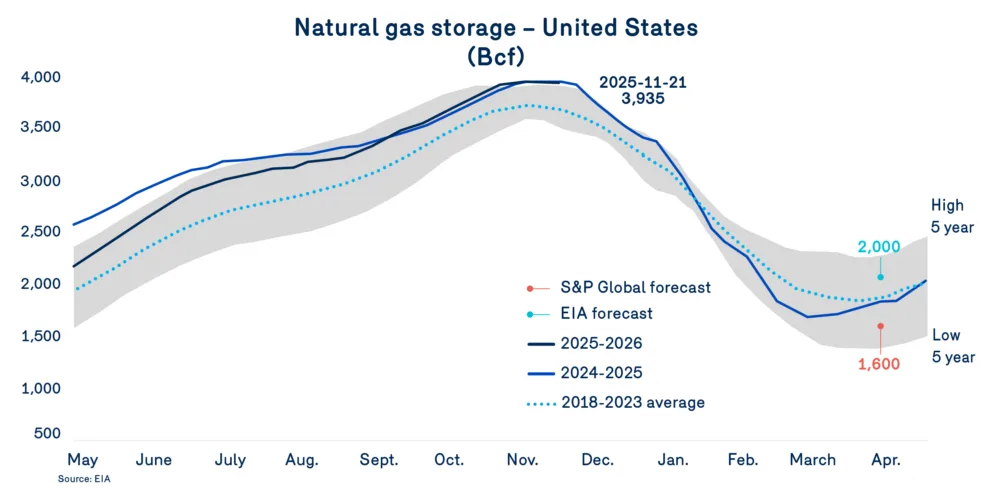

In the United States, the gas market entered the 2025-2026 winter on a positive note, with storages totalling 3,935 Bcf-very near historic highs and sufficient to temper market concerns. Storage is also above historical maximums in the South-Central region, where LNG facilities and exporters are concentrated.

The key question now is how quickly storage levels will decline and what the magnitude of winter withdrawals will be. On this point, the Energy Information Administration (EIA) and the S&P Global Commodity Insights (S&P) offer sharply divergent views, projecting end- of- winter with 2,000 Bcf and 1,600 Bcf, respectively. The EIA’s outlook reflects confidence in production levels, while the latter relies on larger whereas S&P anticipates stronger LNG exports and slightly reduced supply.

Ultimately, market dynamics now depend largely on actual temperatures and forecasts relative to normal seasonal averages. Cold conditions are beginning to settle in, particularly in the Northeastern region of the continent. With storage levels below historical norms, the Northeast –especially New England, -is expected to experience heightened natural gas price volatility driven by temperature fluctuations. This volatility could intensify if December weather is influenced by La Niña, as forecasted by the U.S. National Weather Service. Early December cold already pushed the median price at the Algonquin Hub in Boston to US$13.25/MMBtu, compared with US$7.36/MMBtu at Iroquois® and US$4.42/MMBtu at Dawn.

Winter price forecast

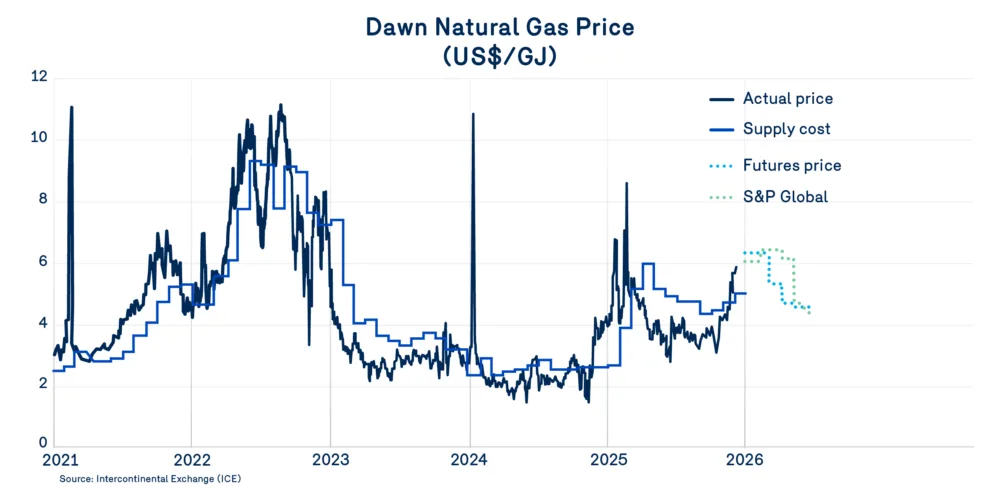

For the reminder of the winter, government agencies expect colder-than-average temperatures across the north-central part of the continent, but warmer temperature conditions in the eastern and southern United States-something to monitor closely. As a result, prices at the Dawn Hub are moving in a more challenging context than last year.

Market conditions in November, along with the outlook for December, are already influencing spot prices and shaping forecasts for the coming months.

Dawn hub prices have risen from around $3/GJ in mid-October to approximately $6/GJ in early December. Futures prices are following a similar trend, ranging between $6/GJ and $7/GJ for January and February 2026.

Despite some differences in forecasts, both the EIA and S&P expect higher production and lower domestic consumption in the U.S. over 2025-2026 winter, particularly in January , compared with last winter. The key point of divergence between the two forecasters lies in different outlooks concerning liquefaction. Certainly, these forecasts of supply and consumption of natural gas mitigate the effects of the storage context in the Northeast on the outlooks partly offset the influence of low Northeastern storage level mood of the futures markets. Nevertheless, as always, actual winter temperatures will ultimately be the determining factor.